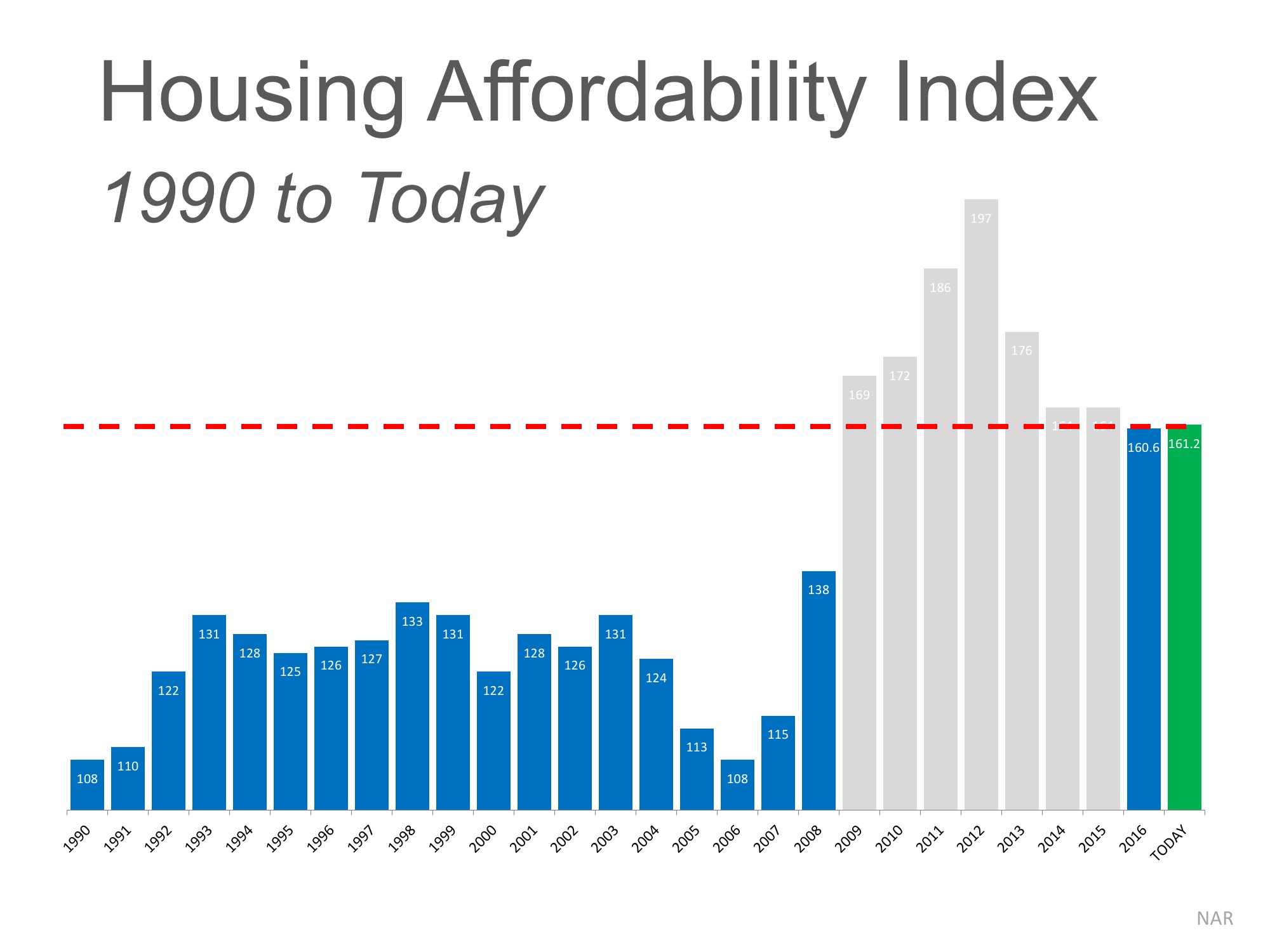

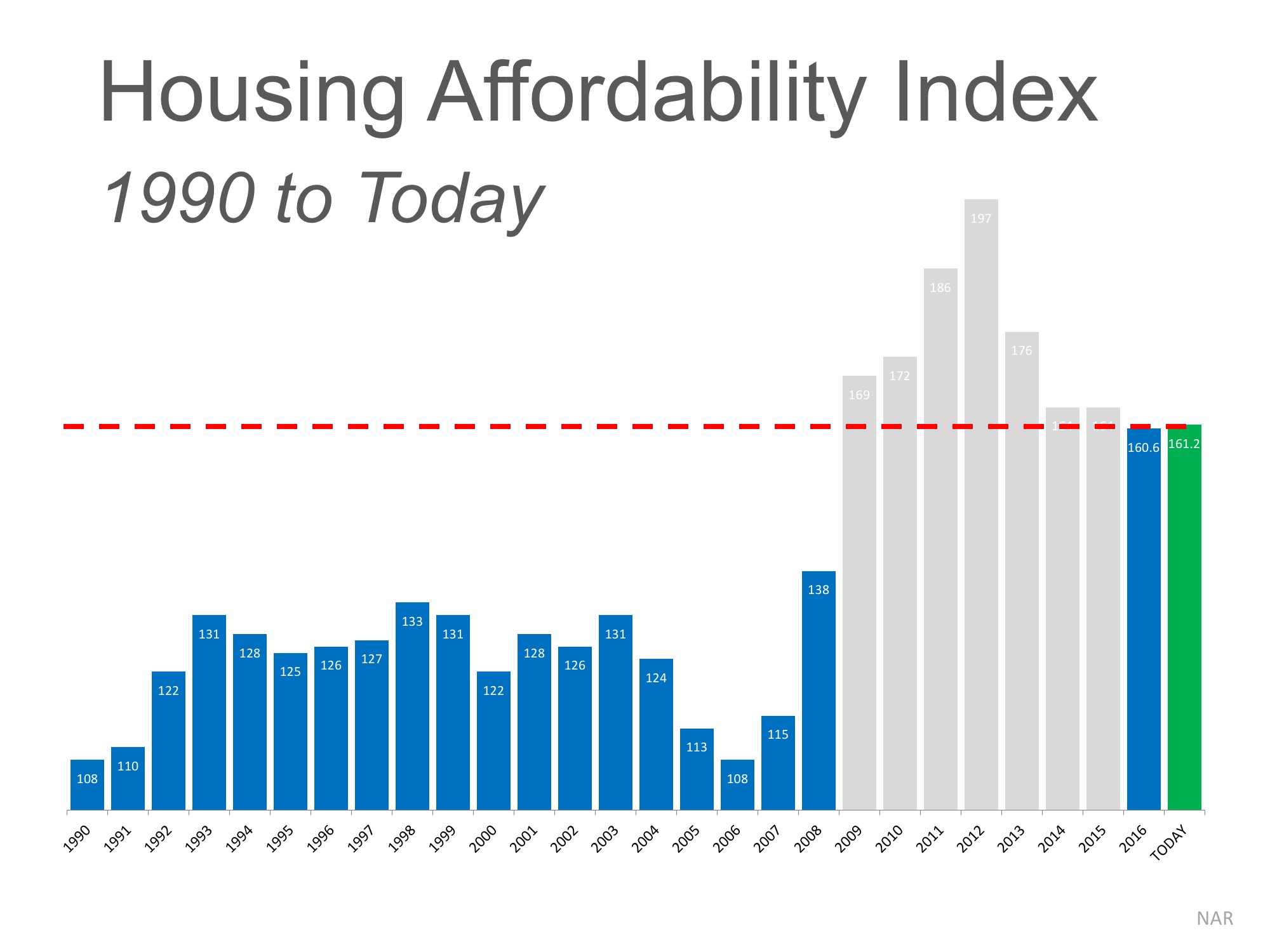

Some industry experts are claiming that the housing market may be

headed for a slowdown as we proceed through 2017, based on rising home

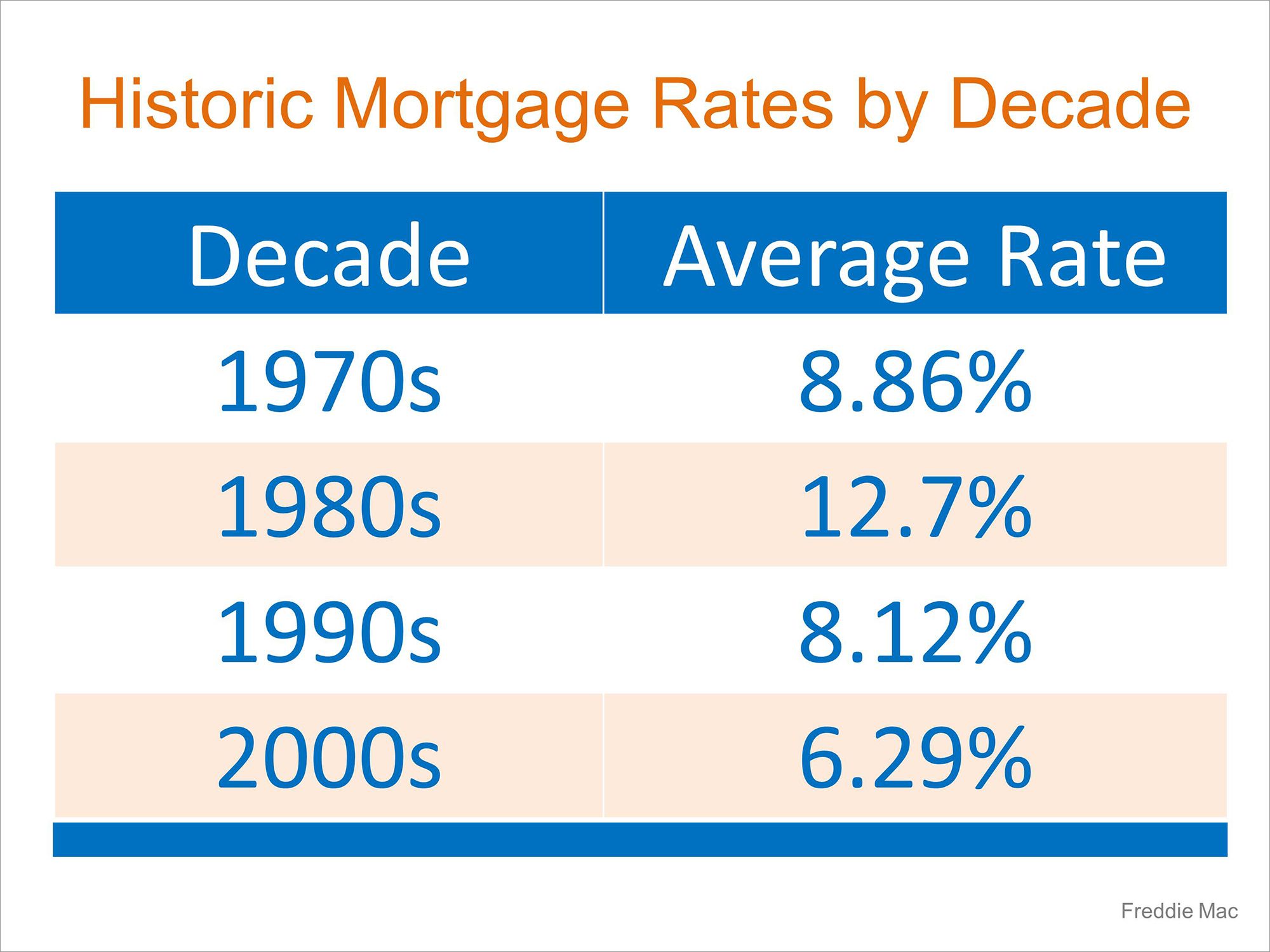

prices and a potential jump in mortgage interest rates. One of the data

points they use is the

Housing Affordability Index, as reported by the

National Association of Realtors (NAR).

Here is how

NAR defines the index:

“The

Housing Affordability Index measures whether or not a typical family

earns enough income to qualify for a mortgage loan on a typical home at

the national level based on the most recent price and income data.”

Basically,

a value of 100 means a family earning the median income earns enough to

qualify for a mortgage on a median-priced home, based on the price and

mortgage interest rates at the time. Anything above 100 means the family

has more than enough to qualify.

The higher the index, the easier it is to afford a home.

Why the concern?

The

index has been declining over the last several years as home values

increased. Some are concerned that too many buyers could be priced out

of the market.

But, wait a minute…

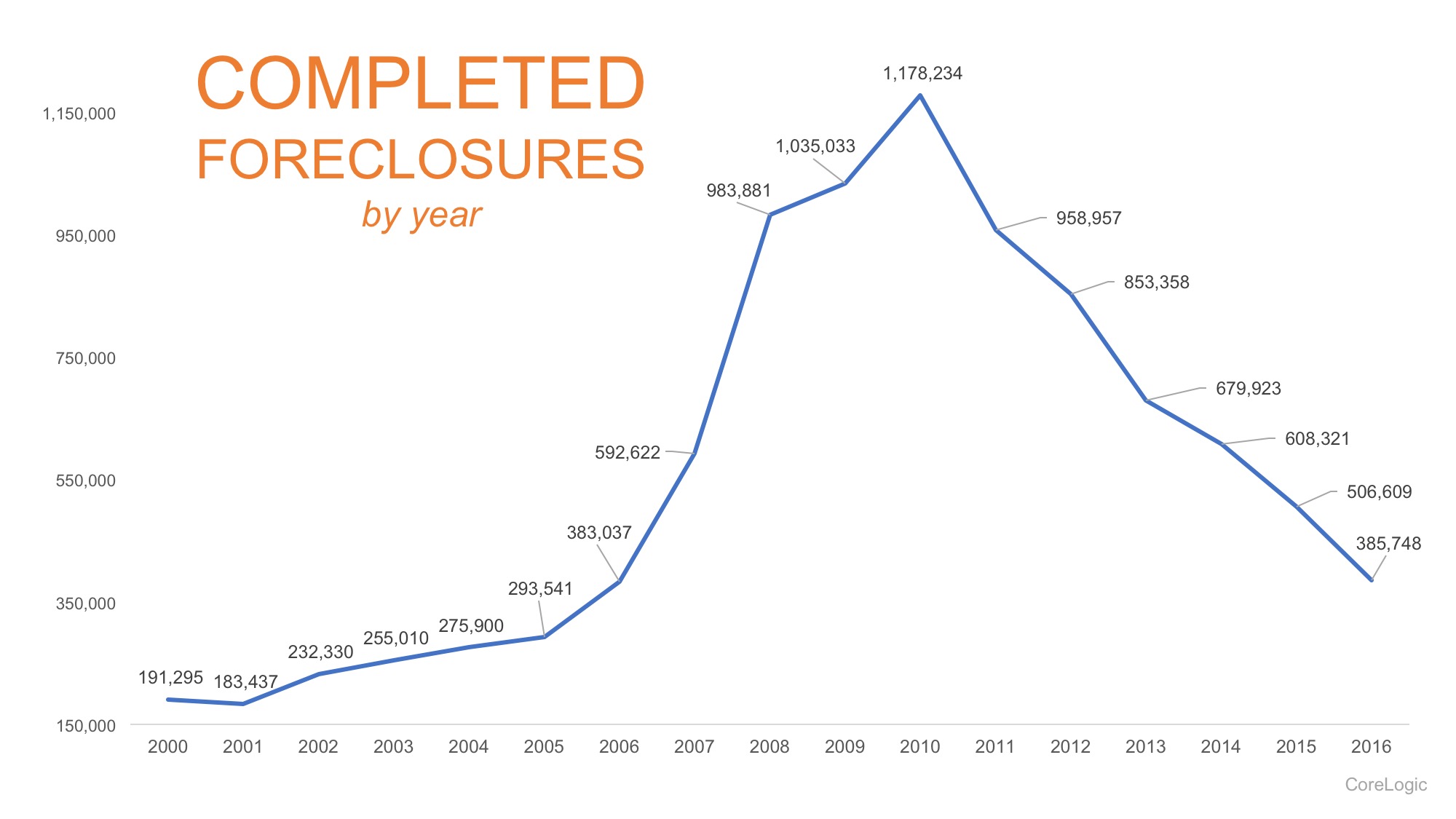

Though the index

skyrocketed from 2009 through 2013, we must realize that during that

time, the housing crisis left the market with an overabundance of

distressed properties (foreclosures and short sales). All prices dropped

dramatically and distressed properties sold at major discounts. Then,

mortgage rates fell like a rock.

The market is recovering, and values are coming back nicely. That has caused the index to fall.

However, let’s remove the crisis years (shaded in gray) and look at the current index as compared to the index from 1990 – 2008:

Though

prices and rates appear to be increasing, we must realize that

affordability is composed of three ingredients: home prices, interest

rates,

and income. And, incomes are finally rising.

ATTOM Data Solutions recently released their

Q1 2017 U.S. Home Affordability Index. The report explained:

“Stronger

wage growth is the silver lining in this report, outpacing home price

growth in more than half of the markets for the first time since Q1

2012, when median home prices were still falling nationwide. If that

pattern continues, it will help turn the tide in the eroding home

affordability trend.”

![Is Your First Home Within Your Grasp? [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/04/11134052/FTHB-Demographics-STM-1046x1477.jpg)

![Why Millennials Choose to Buy [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/03/23122033/Millennials-Choose-to-Buy-STM-1046x1354.jpg)