Buying a home can be intimidating if you are not familiar with the

terms used during the process. To start you on your path with

confidence, we have compiled a list of some of the most common terms

used when buying a home.

Freddie Mac has compiled a more exhaustive glossary of terms in their “

My Home” section of their website.

Annual Percentage Rate (APR)

– This is a broader measure of your cost for borrowing money. The APR

includes the interest rate, points, broker fees and certain other credit

charges a borrower is required to pay. Because these costs are rolled

in, the APR is usually higher than your interest rate.

Appraisal – A professional analysis used to estimate the

value of the property.

This includes examples of sales of similar properties. This is a

necessary step in getting your financing secured as it validates the

home’s worth to you and your lender.

Closing Costs – The costs to complete the real estate transaction. These costs are in addition to the price of the home and are

paid at closing.

They include points, taxes, title insurance, financing costs, items

that must be prepaid or escrowed and other costs. Ask your lender for a

complete list of closing cost items.

Credit Score

– A number ranging from 300-850, that is based on an analysis of your

credit history. Your credit score plays a significant role when securing

a mortgage as it helps lenders determine the likelihood that you’ll

repay future debts. The higher your score, the better, but many buyers

believe they need at least a 780 score to qualify when, in actuality,

over 55% of approved loans had

a score below 750.

Discount Points

– A point equals 1% of your loan (1 point on a $200,000 loan = $2,000).

You can pay points to buy down your mortgage interest rate. It’s

essentially an upfront interest payment to lock in a lower rate for your

mortgage.

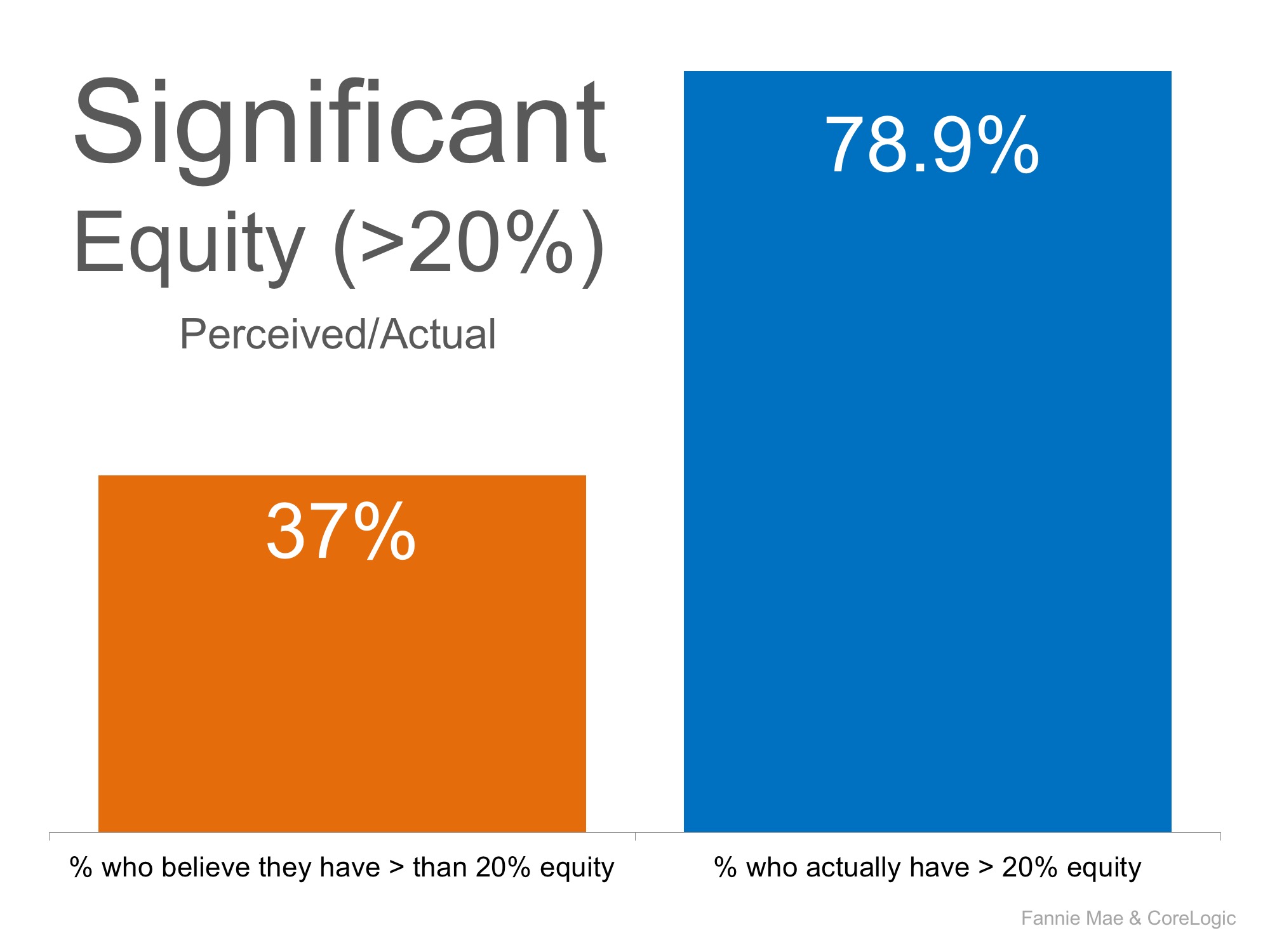

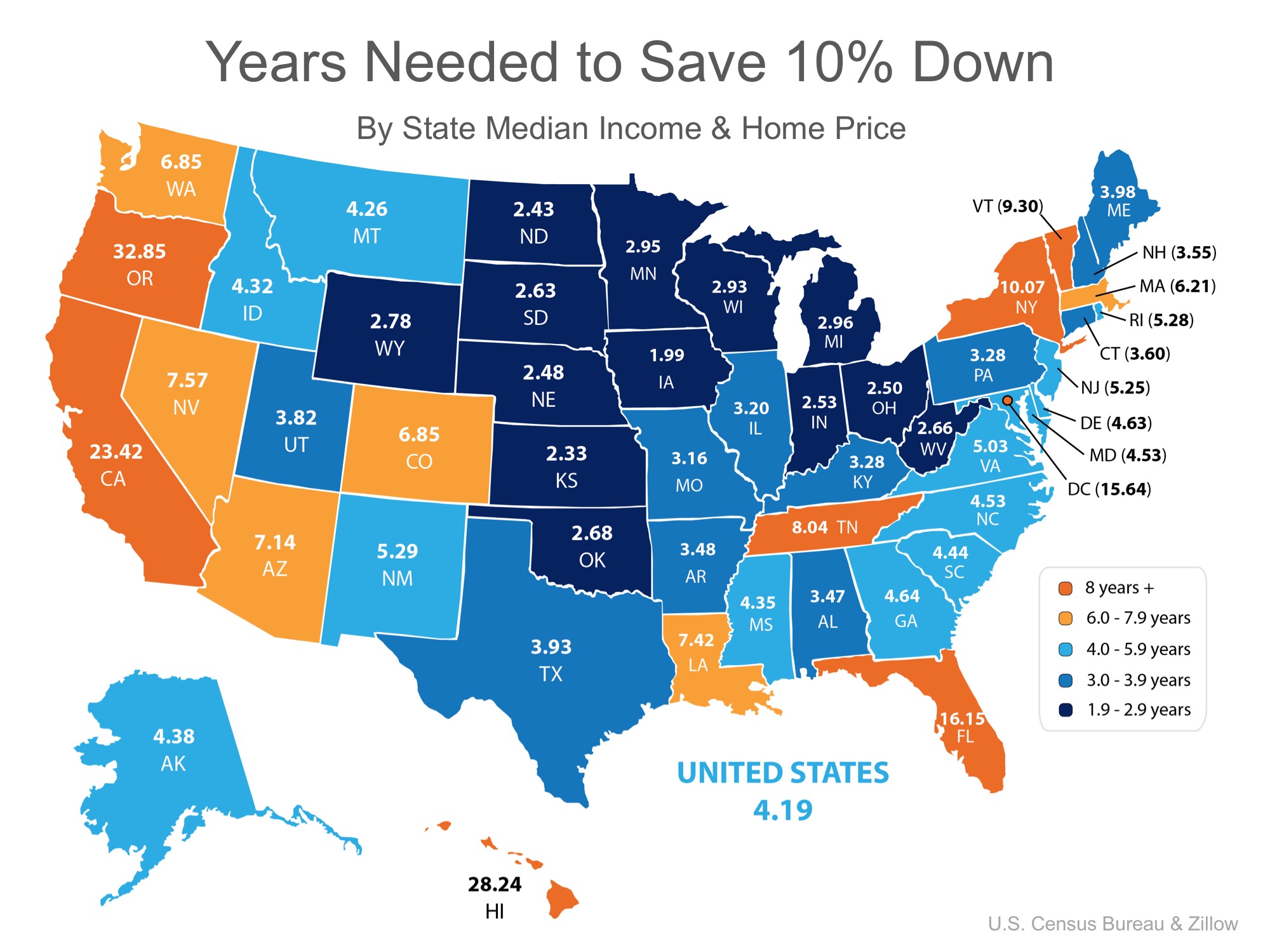

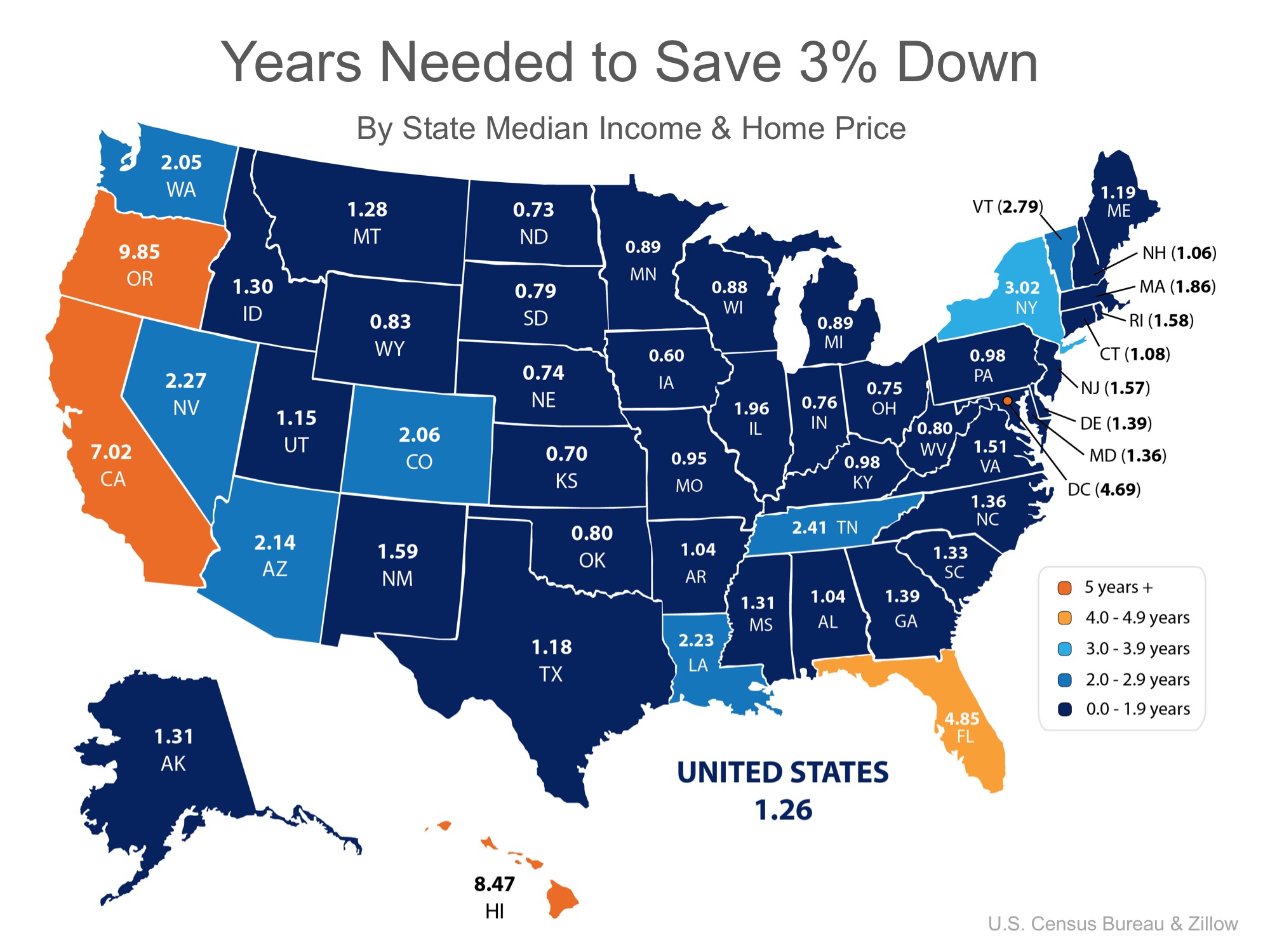

Down Payment – This is a portion of

the cost of your home that you pay upfront to secure the purchase of the

property. Down payments are typically 3 to 20% of the purchase price of

the home. There are zero-down programs available through VA loans for

Veterans, as well as USDA loans for rural areas of the country.

Eighty percent of first-time buyers put less than 20% down last month.

Escrow –

The holding of money or documents by a neutral third party before

closing. It can also be an account held by the lender (or servicer) into

which a homeowner pays money for taxes and insurance.

Fixed-Rate Mortgages

– A mortgage with an interest rate that does not change for the entire

term of the loan. Fixed-rate mortgages are typically 15 or 30 years.

Home Inspection – A professional inspection of a home to determine the condition of the property. The

inspection should include an evaluation of the plumbing, heating and cooling systems, roof, wiring, foundation and pest infestation.

Mortgage Rate –

The interest rate you pay to borrow money to buy your house. The lower

the rate, the better. Interest rates for a 30-year fixed rate mortgage

have hovered

between 4 and 4.25% for most of 2017.

Pre-Approval Letter

– A letter from a mortgage lender indicating that you qualify for a

mortgage of a specific amount. It also shows a home seller that you're a

serious buyer. Having a

pre-approval letter in hand while shopping for homes can help you move faster, and with greater confidence, in competitive markets.

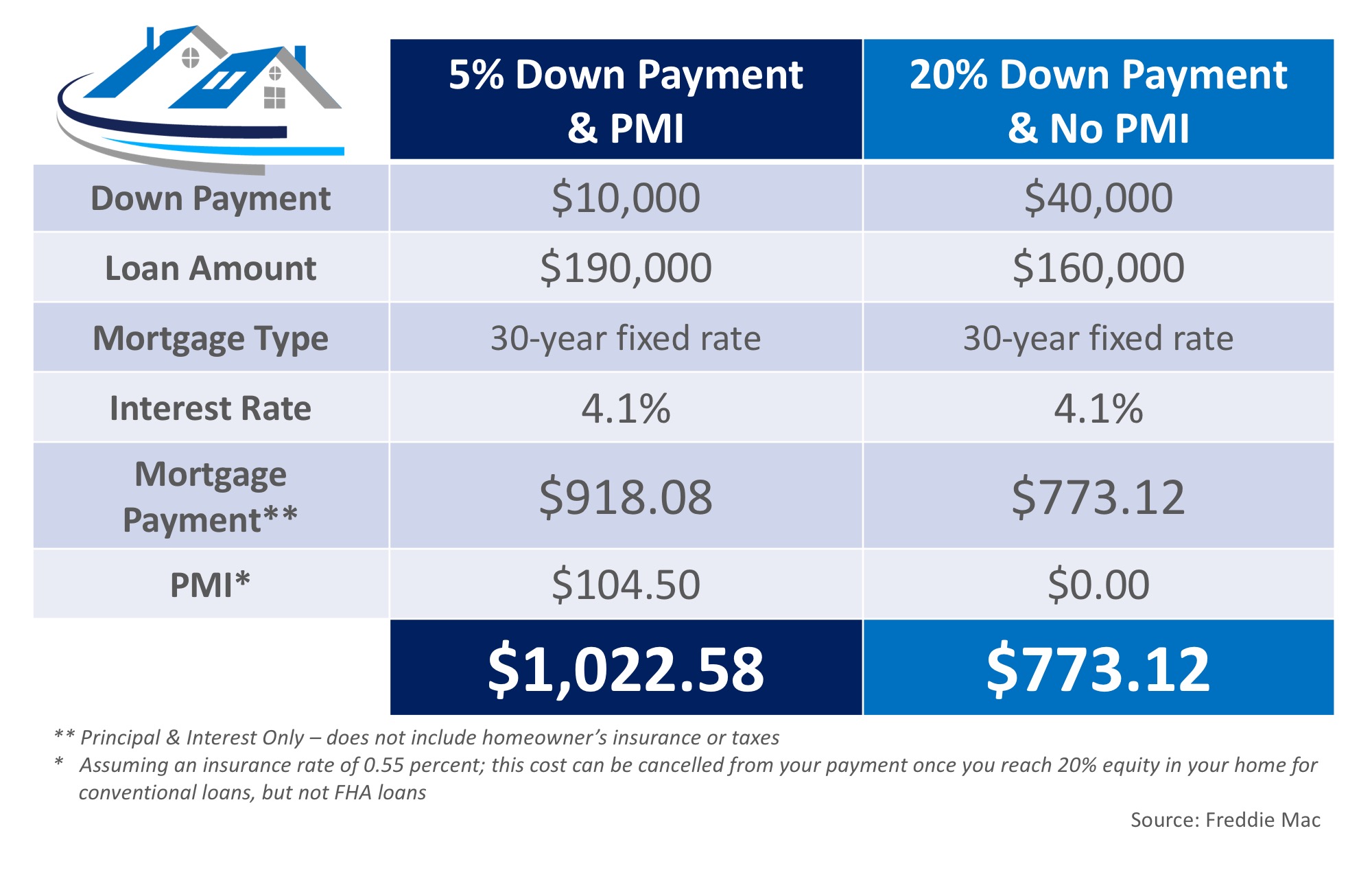

Primary Mortgage Insurance (PMI)

– If you make a down payment lower than 20% on your conventional loan,

your lender will require PMI, typically at a rate of .51%. PMI serves as

an added insurance policy that protects the lender if you are unable to

pay your mortgage and can be cancelled from your payment once you reach

20% equity in your home. For more information on how PMI can impact

your monthly housing cost,

click here.

Real Estate Professional – An

individual who provides services

in buying and selling homes. Real estate professionals are there to

help you through the confusing paperwork, to help you find your dream

home, to negotiate any of the details that come up, and to help make

sure that you know exactly what’s going on in the housing market. Real

estate professionals can refer you to local lenders or mortgage brokers

along with other specialists that you will need throughout the

home-buying process.

The best way to ensure that your

home-buying process is a confident one is to find a real estate

professional who will guide you through every aspect of the transaction

with ‘the heart of a teacher,’ and who puts your family’s needs first.

![Inventory Challenges Continue! [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/05/25165433/20170526-EHS-APR-PAT-STM-1046x1354.jpg)

![Do You Know the Cost of Waiting? [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/05/04122148/20170505-Cost-of-Waiting-STM-1046x1354.jpg)