CoreLogic’s latest Equity Report revealed that one million borrowers regained equity in their homes in 2015. The outlook for 2016 remains positive as well, as an additional 850,000 properties would regain equity if home prices rose another 5% this year.

The study also revealed:

- 95% of homes valued over $200,000 now have a positive equity position

- 87% of homes valued under $200,000 have entered a positive position

- The 11.5% growth in home equity in Q4 marked the 13th consecutive quarter of double digit gains

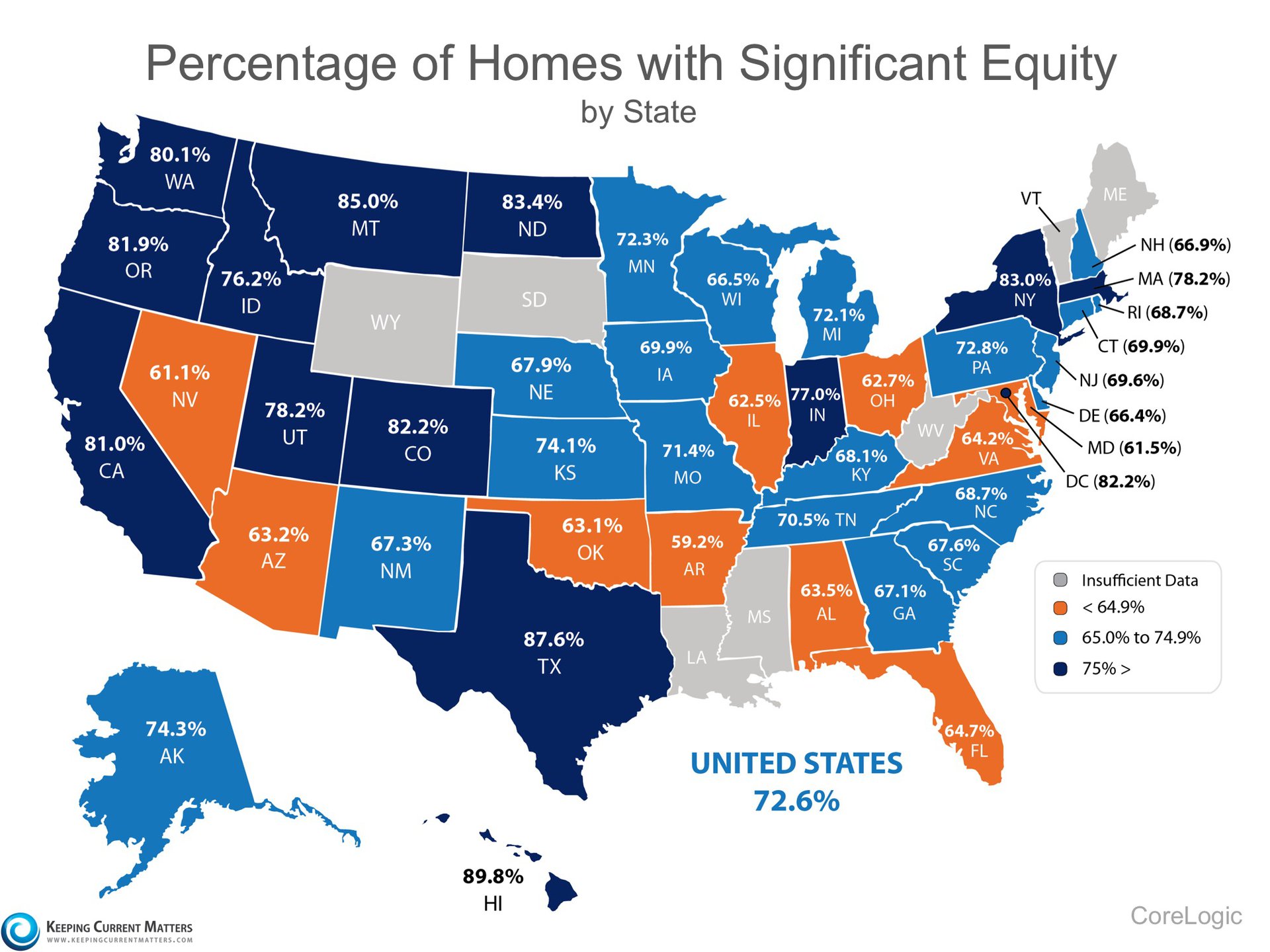

Significant Equity Is On The Rise

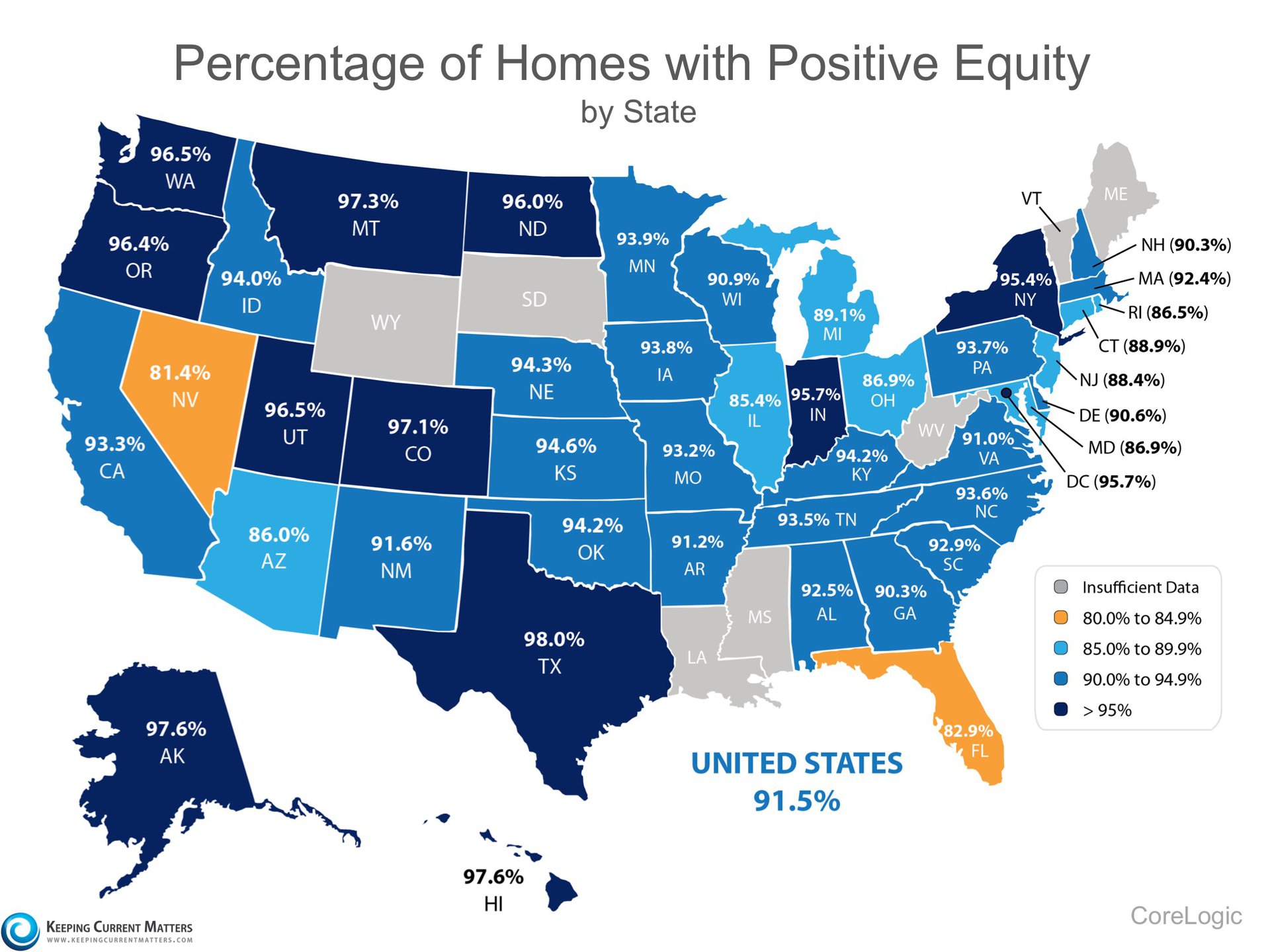

Anand Nallathambi, President & CEO of CoreLogic, believes this is great news for the “long-term health of the U.S. economy.” He went on to say:“The number of homeowners with more than 20% equity is rising rapidly. Higher prices driven largely by tight supply are certainly a big reason for the rise, but continued population growth, household formation and ultralow interest rates are also factors.”Of the 91.5% of homeowners with positive equity in the US, 72.6% have significant equity (defined as more than 20%). This means that nearly three out of four homeowners with a mortgage could use the equity in their current home to purchase a new home now.

The map below shows the percentage of homes with a mortgage, in each state, with significant equity.

No comments:

Post a Comment