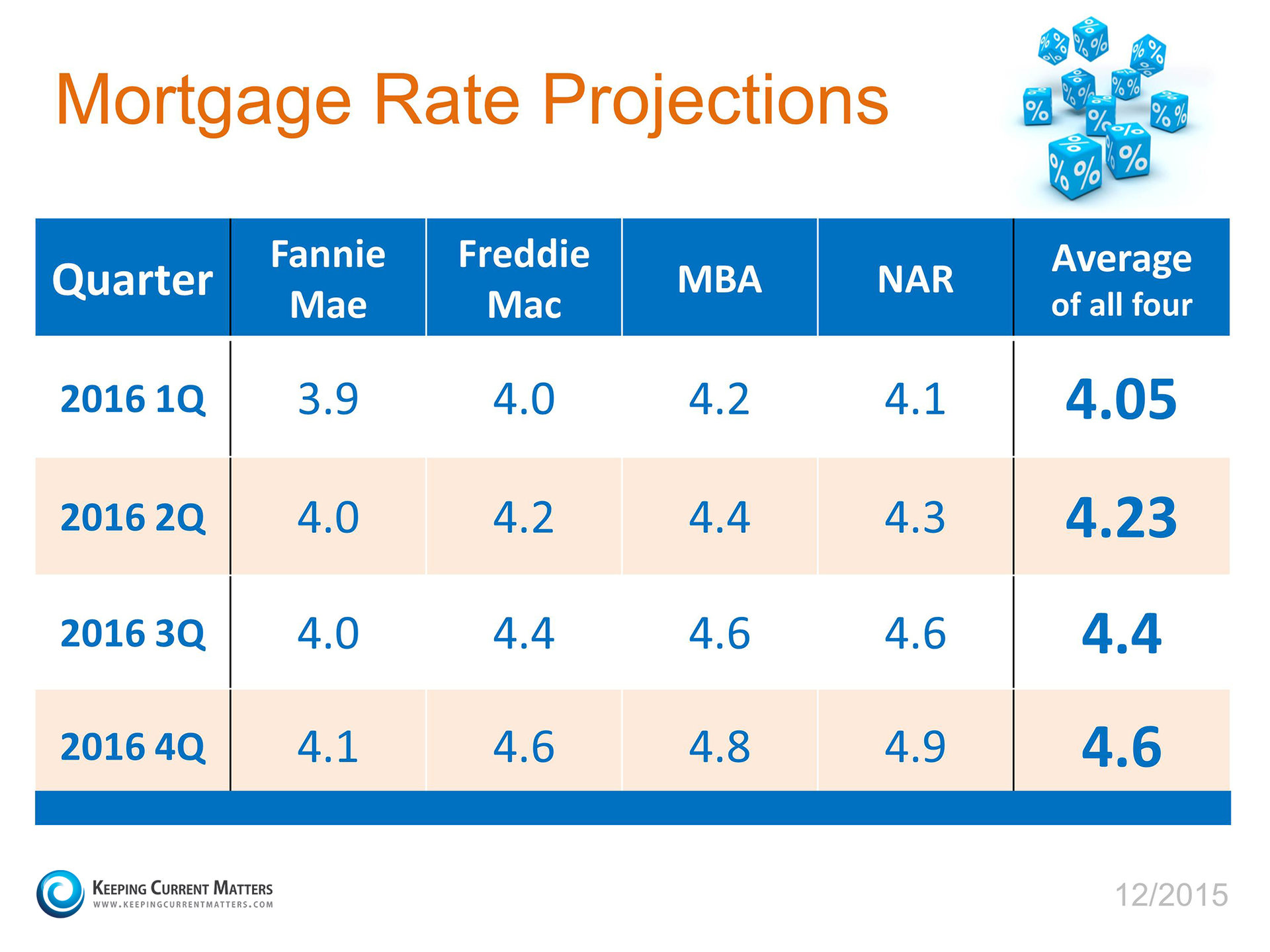

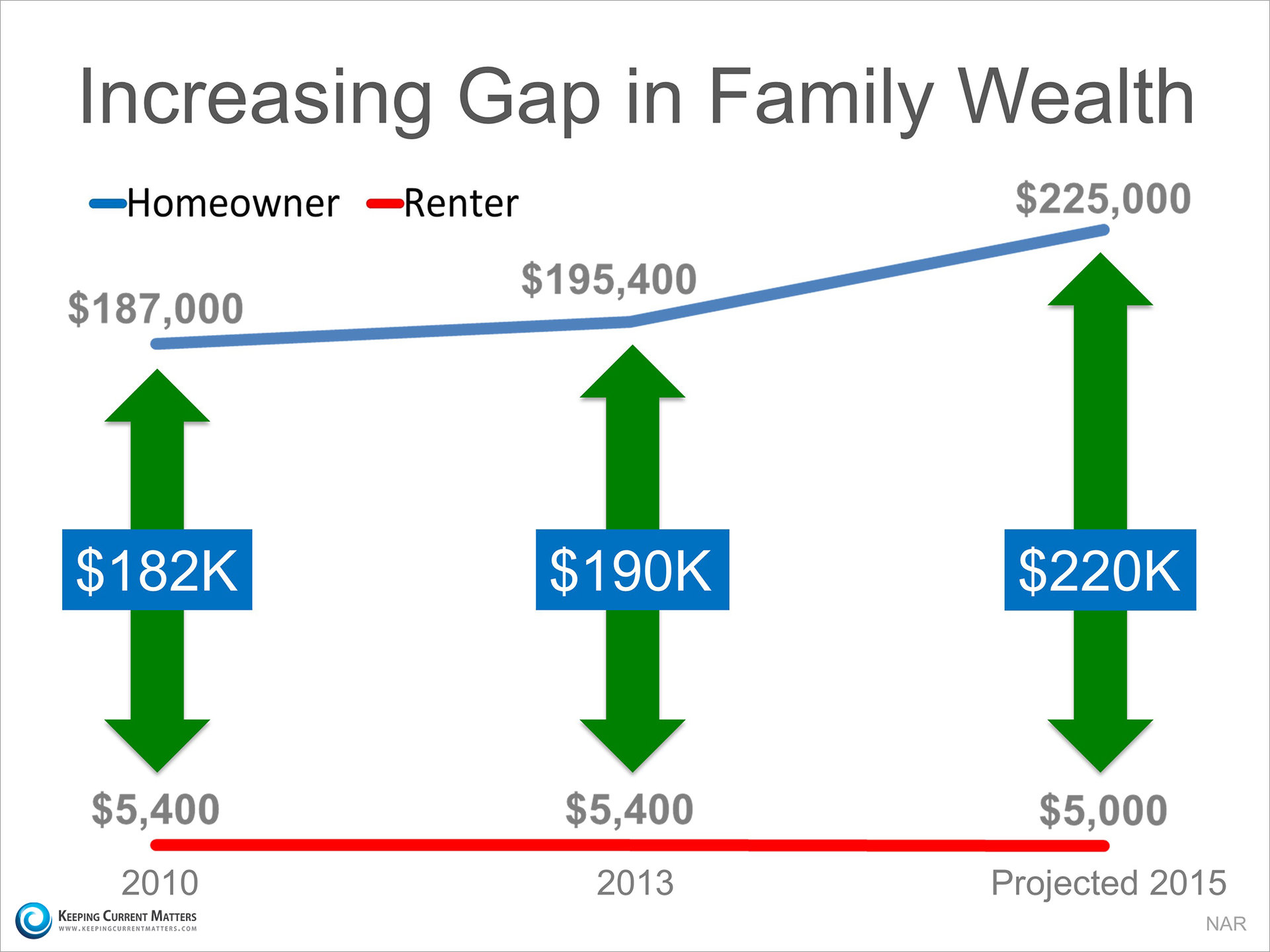

There are many benefits to homeownership. One of the top ones is being able to protect yourself from rising rents and lock in your housing cost for the life of your mortgage.

Don’t Become Trapped

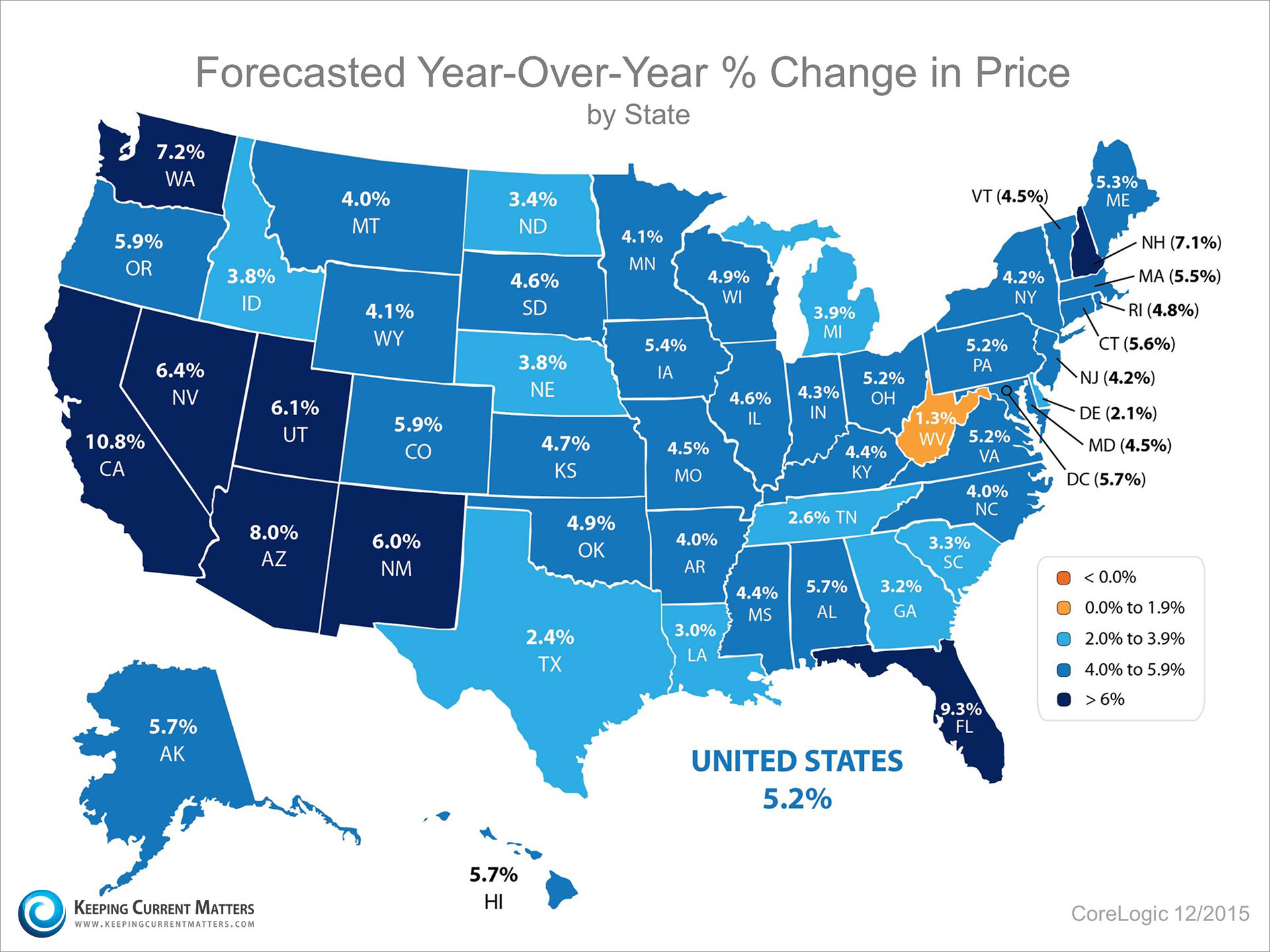

Jonathan Smoke, Chief Economist at realtor.com recently reported on what he calls a “Rental Affordability Crisis”. He warns that,“Low rental vacancies and a lack of new rental construction are pushing up rents, and we expect that they’ll outpace home price appreciation in the year ahead.”The Joint Center for Housing Studies at Harvard University recently released their 2015 Report on Rental Housing, in which they reported that 49% of rental households are cost-burdened, meaning they spend more than 30% of their income on housing. These households struggle to save for a rainy day and pay other bills, such as food and healthcare.

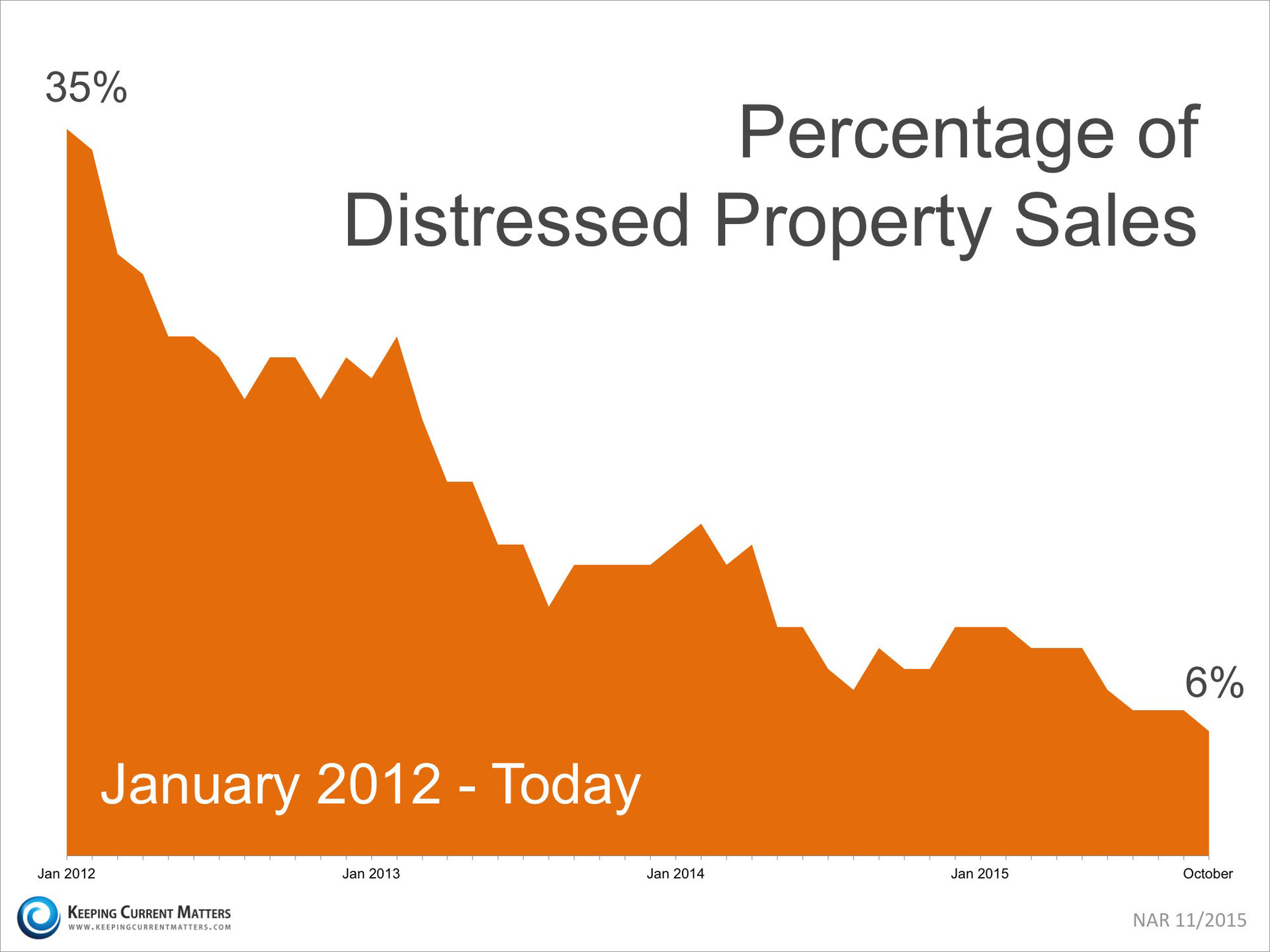

It’s Cheaper to Buy Than Rent

In Smoke’s article, he went on to say,“Housing is central to the health and well-being of our country and our local communities. In addition, this (rental affordability) crisis threatens the future value of owned housing, as the burdensome level of rents will trap more aspiring owners into a vicious financial cycle in which they cannot save and build a solid credit record to eventually buy a home.”

“While more than 85% of markets have burdensome rents today, it’s perplexing that in more than 75% of the counties across the country, it is actually cheaper to buy than rent a home. So why aren’t those unhappy renters choosing to buy?”

Know Your Options

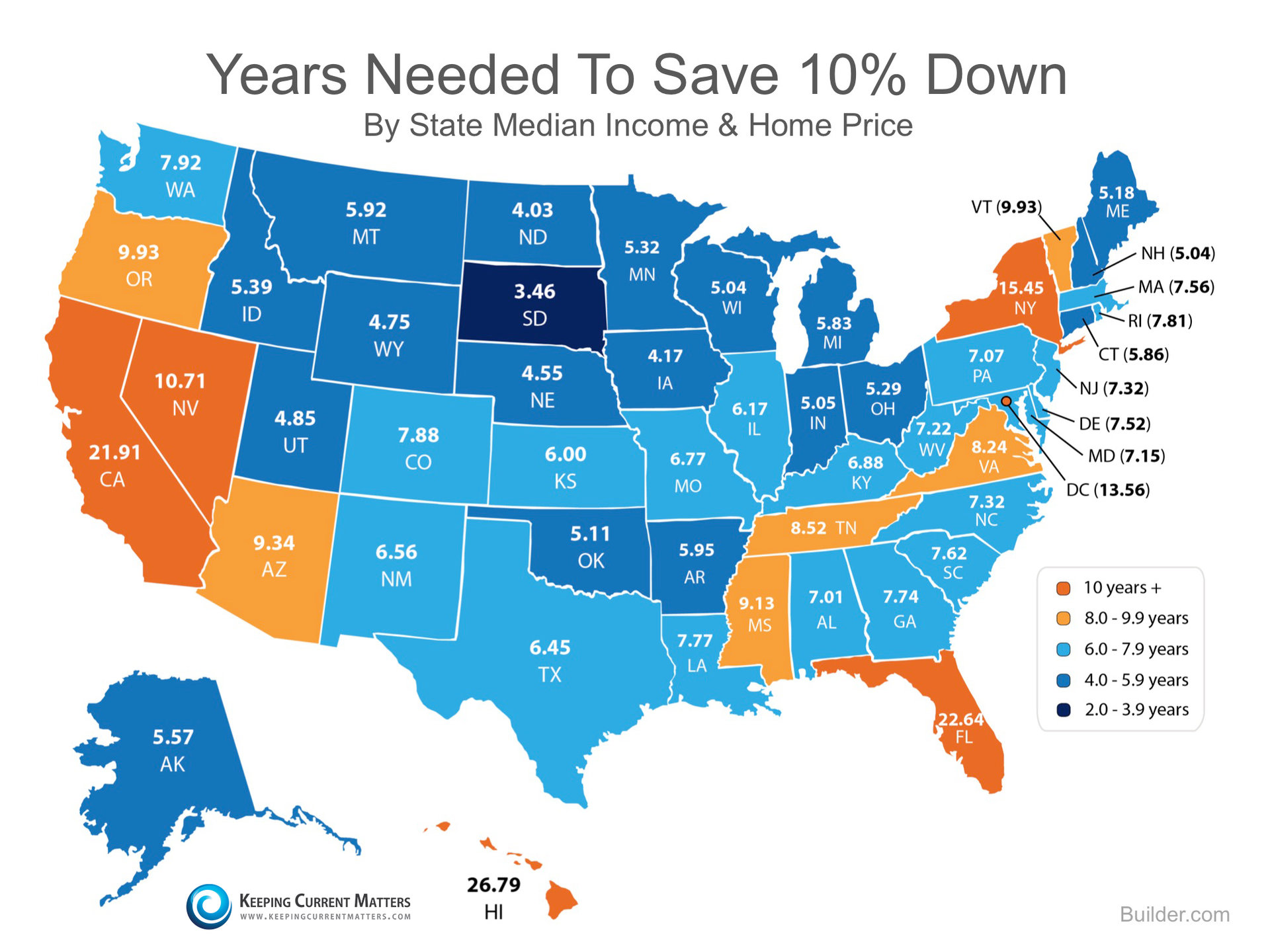

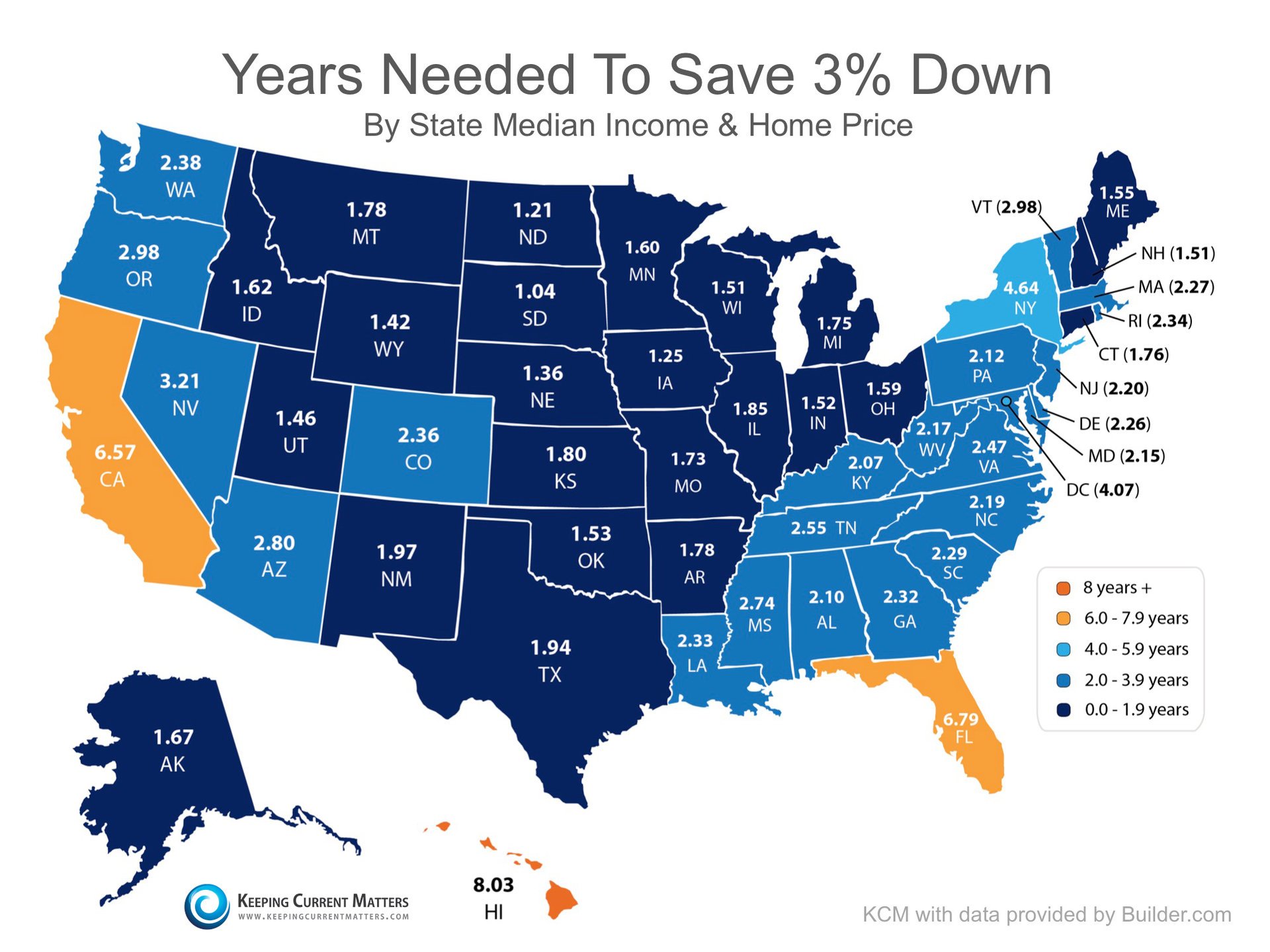

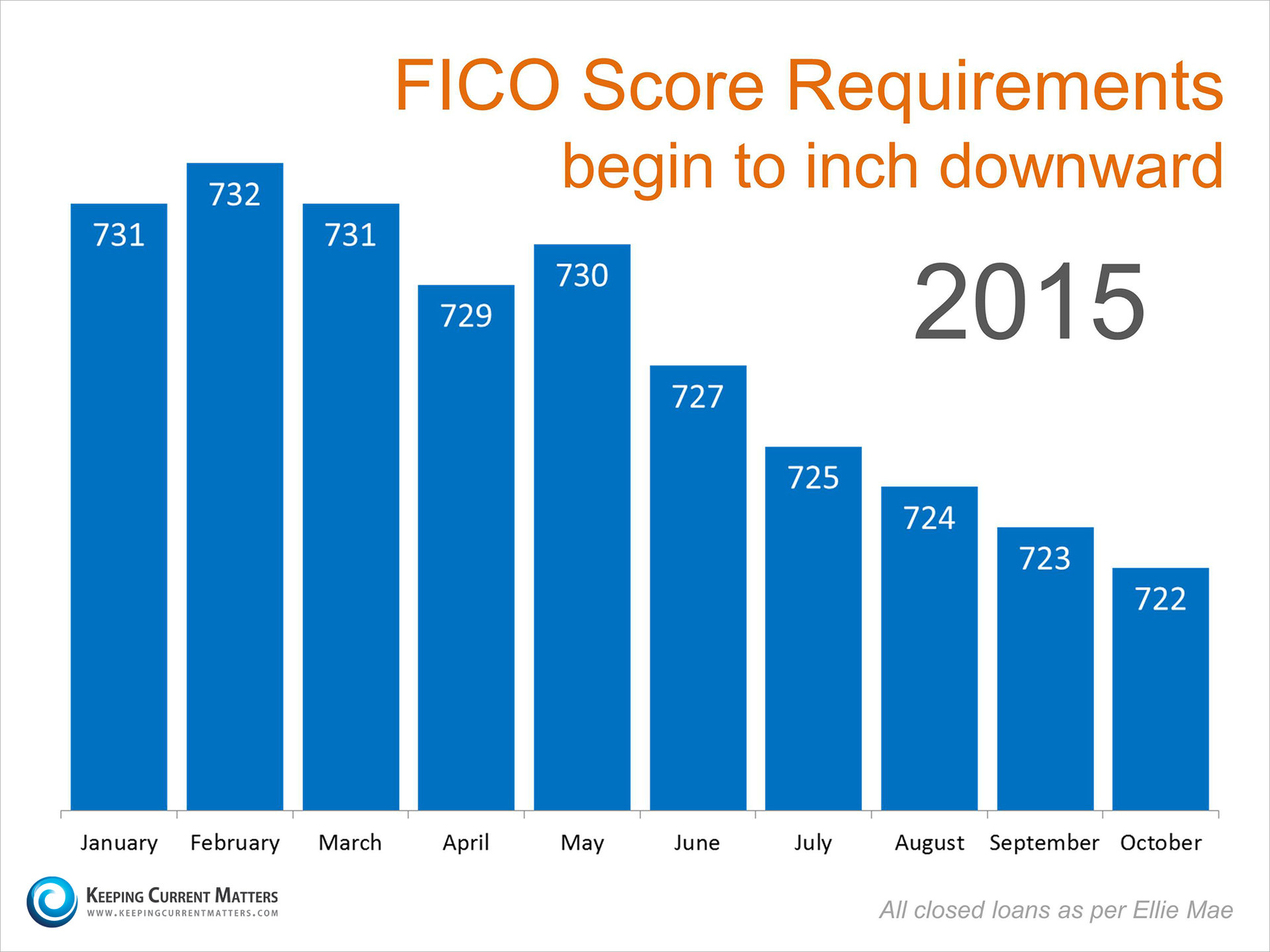

Perhaps, you have already saved enough to buy your first home. HousingWire reported that analysts at Nomura believe:“It’s not that Millennials and other potential homebuyers aren’t qualified in terms of their credit scores or in how much they have saved for their down payment.Many first-time homebuyers who believe that they need a large down payment may be holding themselves back from their dream home. As we reported last week, in many areas of the country, a first-time home buyer can save for a 3% down payment in less than two years. You may have already saved enough!

It’s that they think they’re not qualified or they think that they don’t have a big enough down payment.” (emphasis added)

![Do You Know The Difference Your Interest Rate Makes? [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/12/Cost-of-Interest-KCM.jpg)

![Existing Home Sales Up 3.9% [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/NAR-EHS-October-KCM.jpg)

![Singles Are Falling For Their Dream Home [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/Single-Home-Buyers-KCM.jpg)

![Fannie Mae Housing Market [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/Fannie-Mae-Housing-Market-KCM.jpg)

![Buying A Home Can Be Scary... Until You Know the FACTS! [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/10/Mythbusters-KCM.jpg)

![Existing Home Sales Slow Amongst Tight Inventory [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/09/EHS-SEP.jpg)