How to Get the Most Money When Selling Your Home

Every homeowner wants to make sure they get the best price when

selling their home. But how do you guarantee that you receive maximum

value for your house? Here are two keys to ensuring you get the highest

price possible.

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price it so that demand for the home is maximized. By doing this, the seller will not be fighting with a buyer over the price, but will instead have multiple buyers fighting with each other over the house.

Realtor.com gives this advice:

Research posted by the National Association of Realtors revealed that:

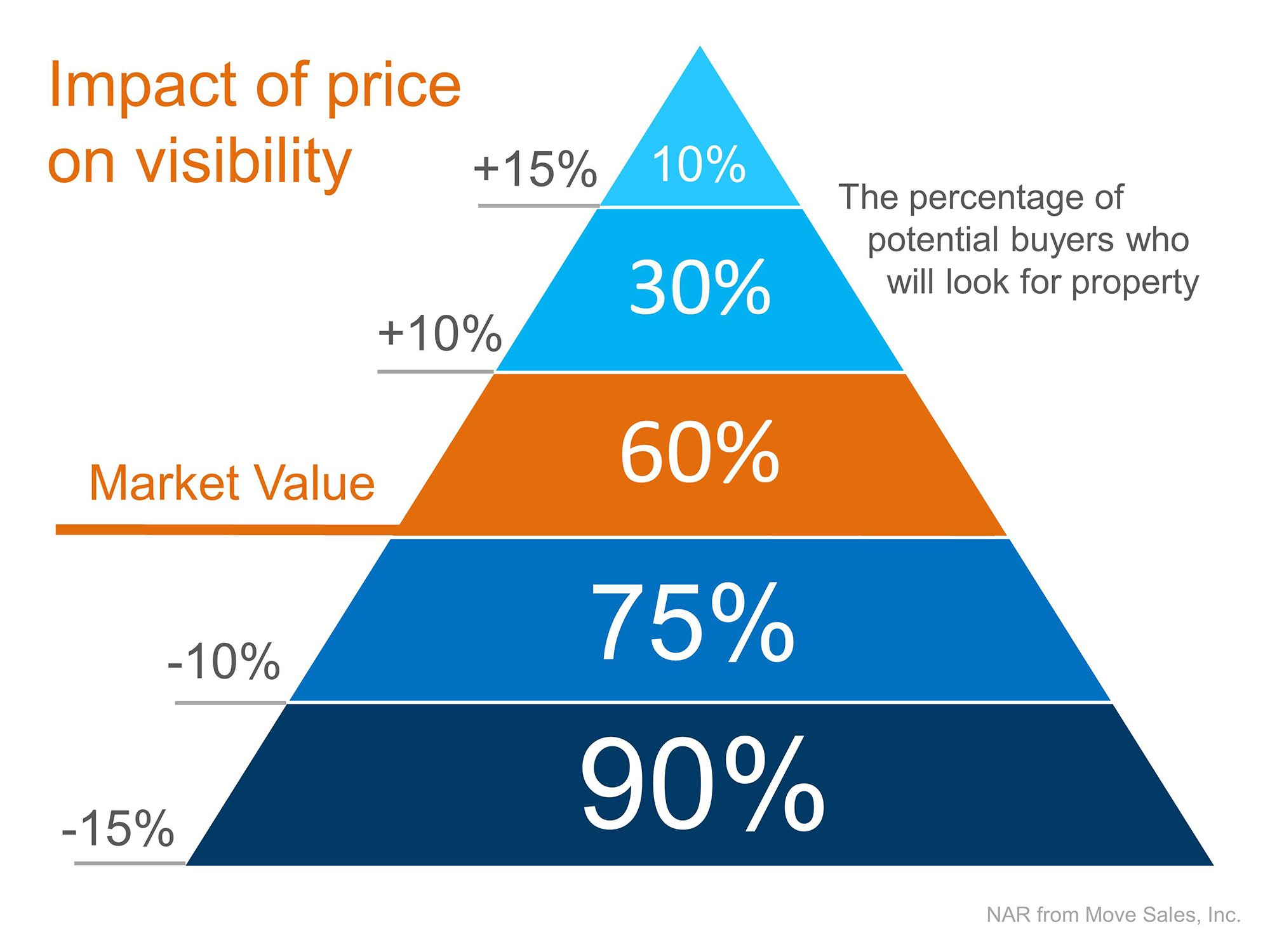

1. Price it a LITTLE LOW

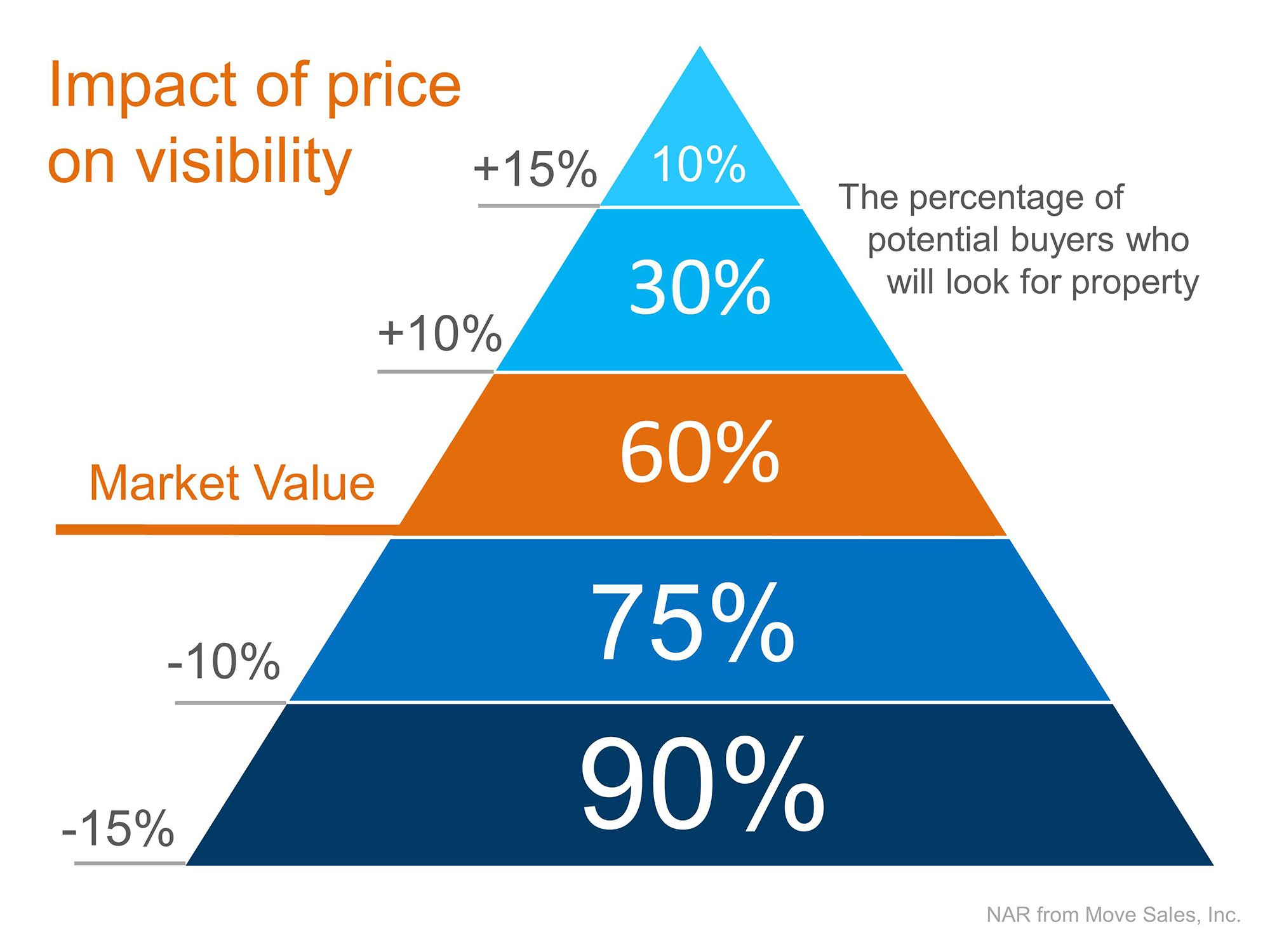

This may seem counterintuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER market value will leave them room for negotiation. In reality, this just dramatically lessens the demand for their house (see chart below).

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price it so that demand for the home is maximized. By doing this, the seller will not be fighting with a buyer over the price, but will instead have multiple buyers fighting with each other over the house.

Realtor.com gives this advice:

“Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly underpriced, especially in areas with low inventory.”

2. Use a Real Estate Professional

This, too, may seem counterintuitive, as the seller likely believes that he or she will net more money if they don’t have to pay a real estate commission. With that being said, studies have shown that homes typically sell for more money when handled by a real estate professional.Research posted by the National Association of Realtors revealed that:

“The median selling price for all FSBO homes was $185,000 last year. When the buyer knew the seller in FSBO sales, the number sinks to the median selling price of $163,800. However, homes that were sold with the assistance of an agent had a median selling price of $245,000 – nearly $60,000 more for the typical home sale.”

![Don’t Let Your Luck Run Out [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/03/15162454/20170317-Luck-STM-1046x1354.jpg)