There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As The Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return.Christina Boyle, a Senior Vice President, Head of Single-Family Sales & Relationship Management at Freddie Mac, explains another benefit of securing a mortgage vs. paying rent:

That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

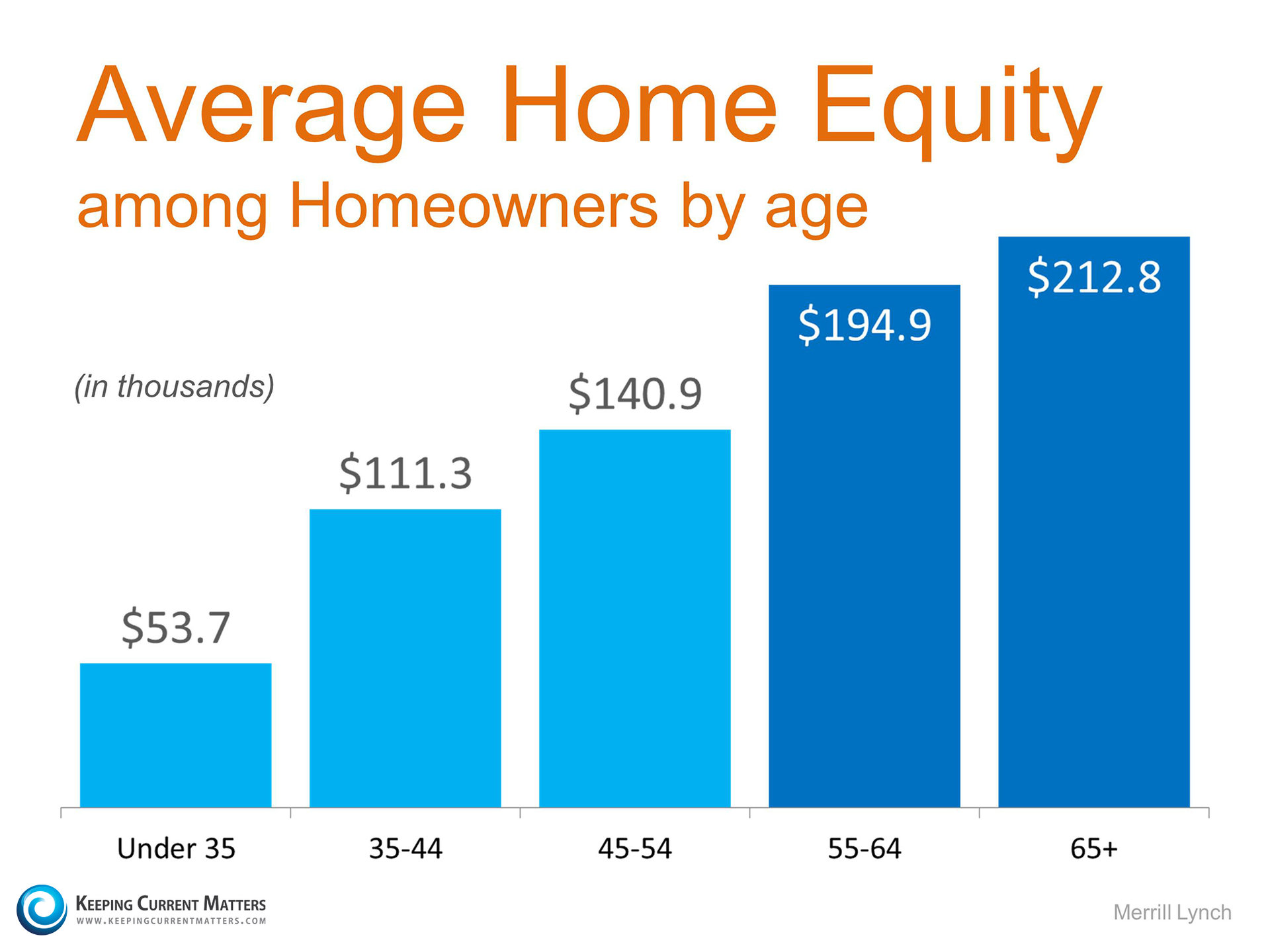

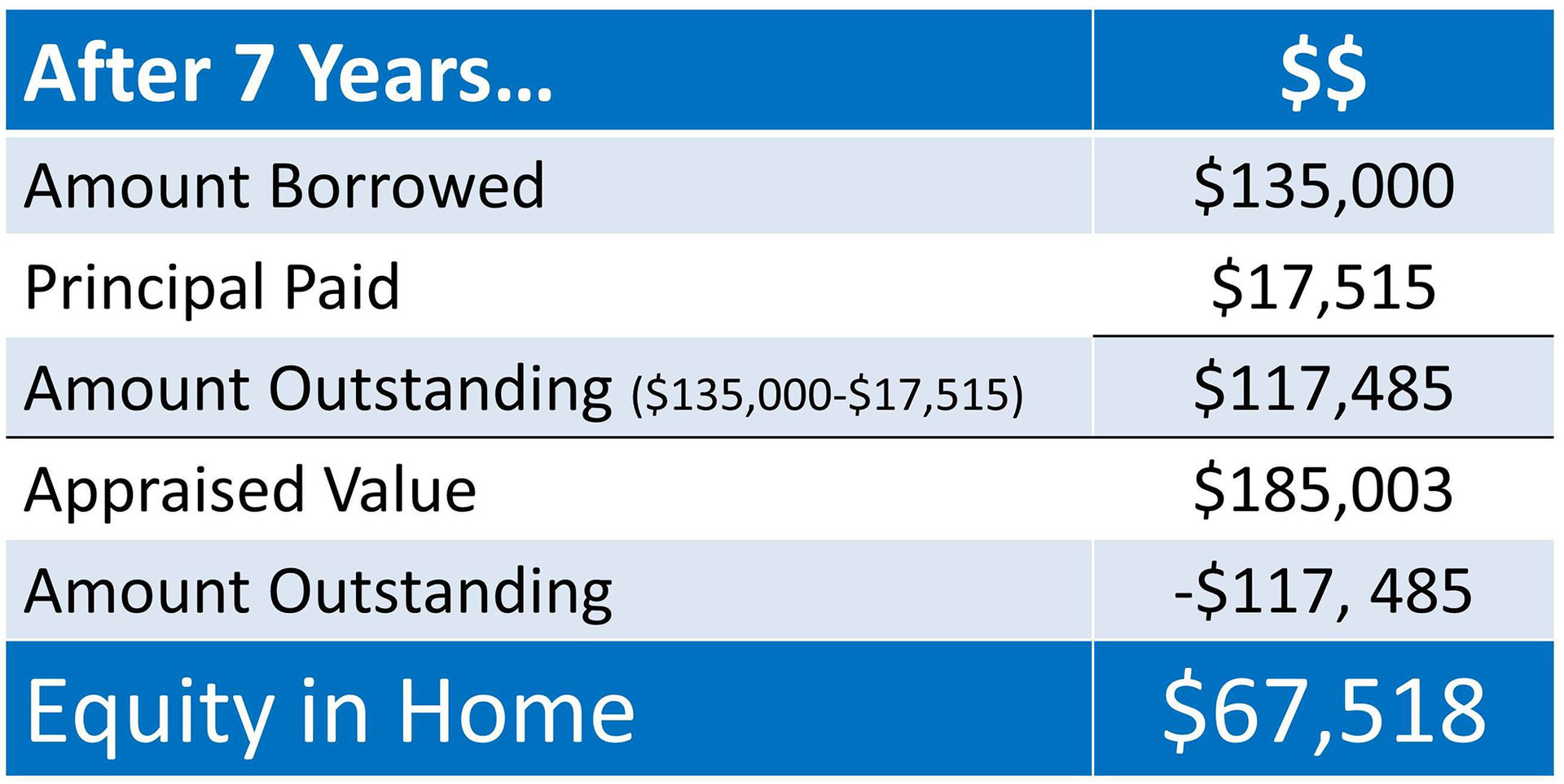

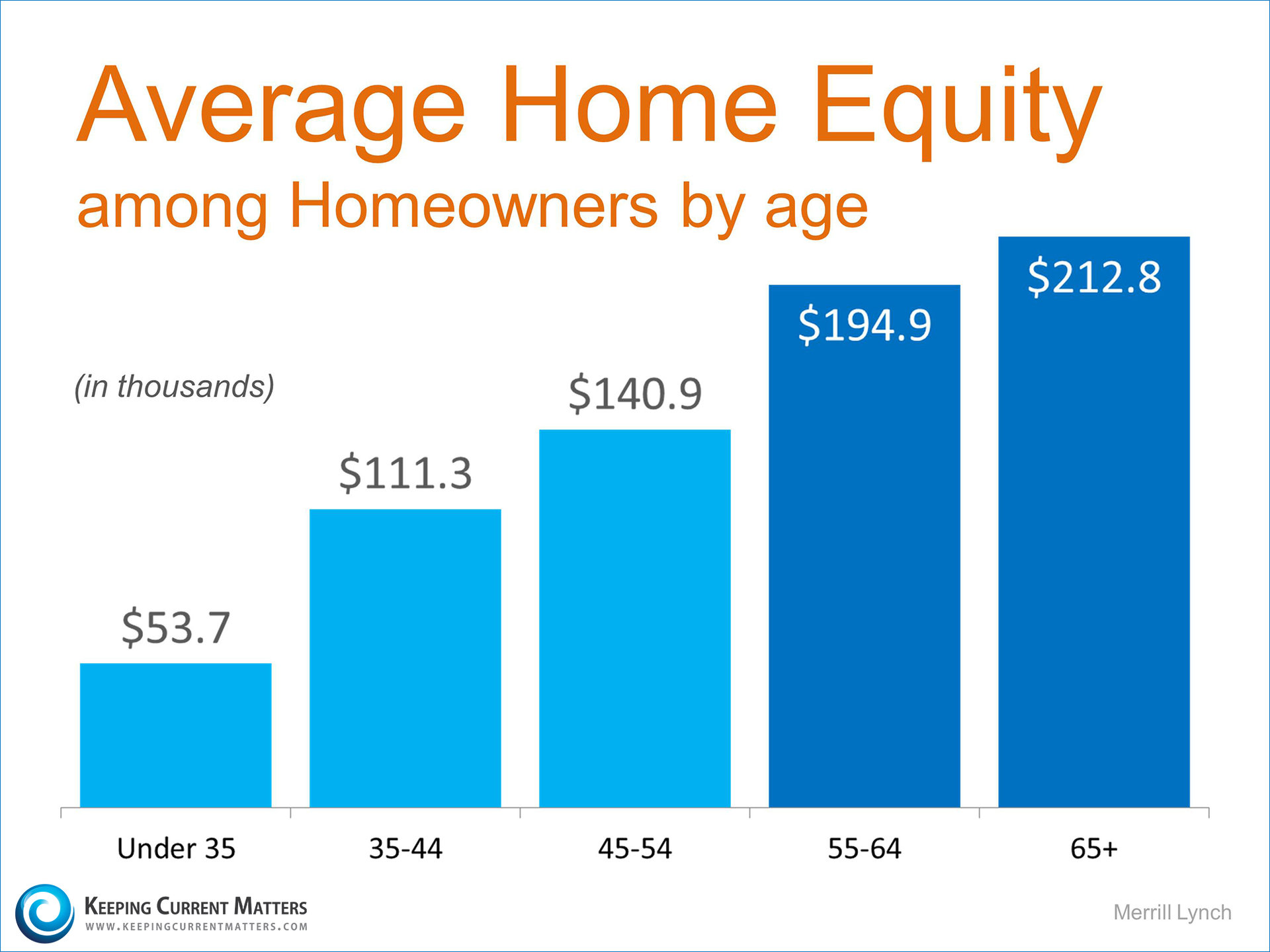

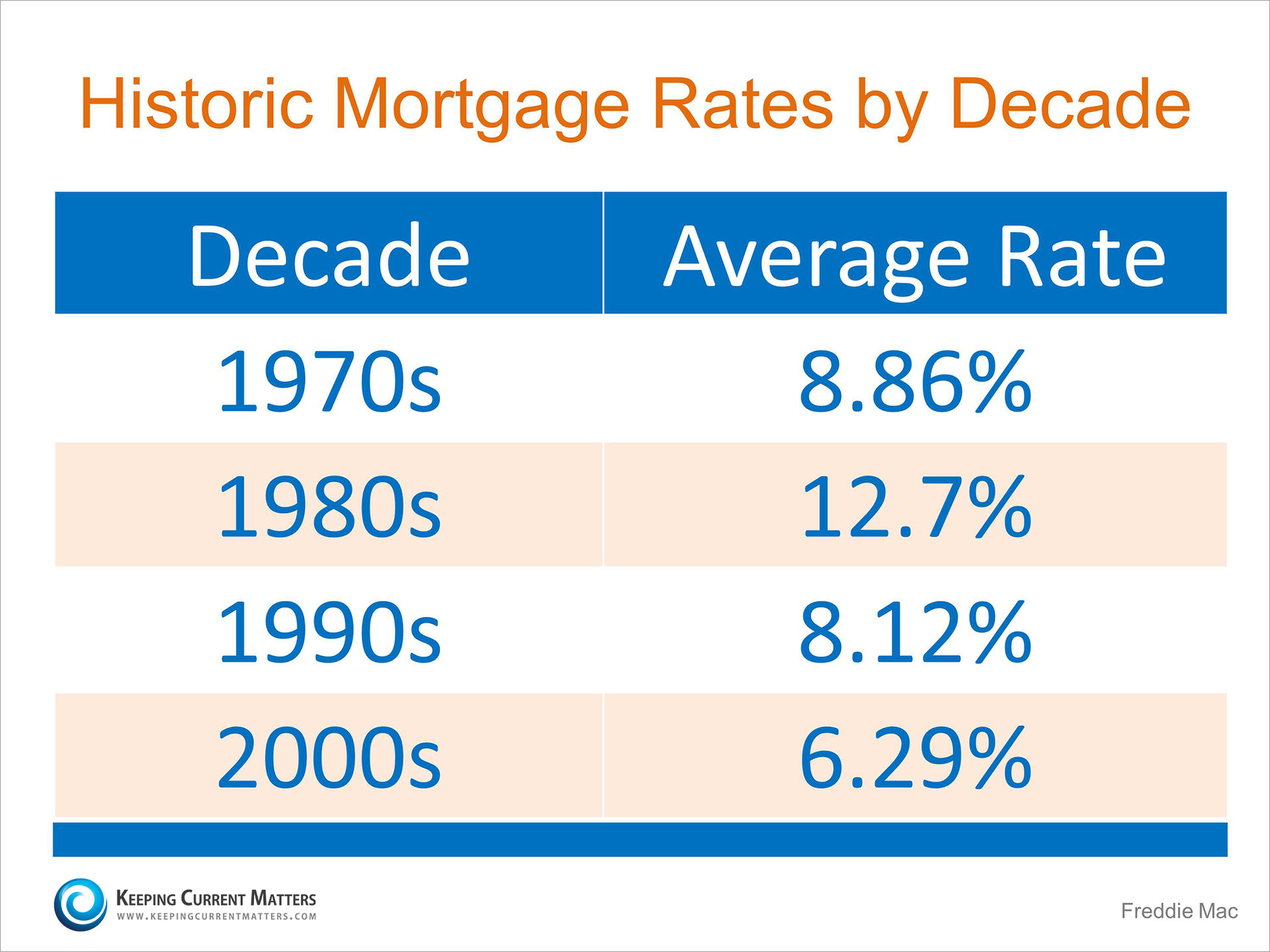

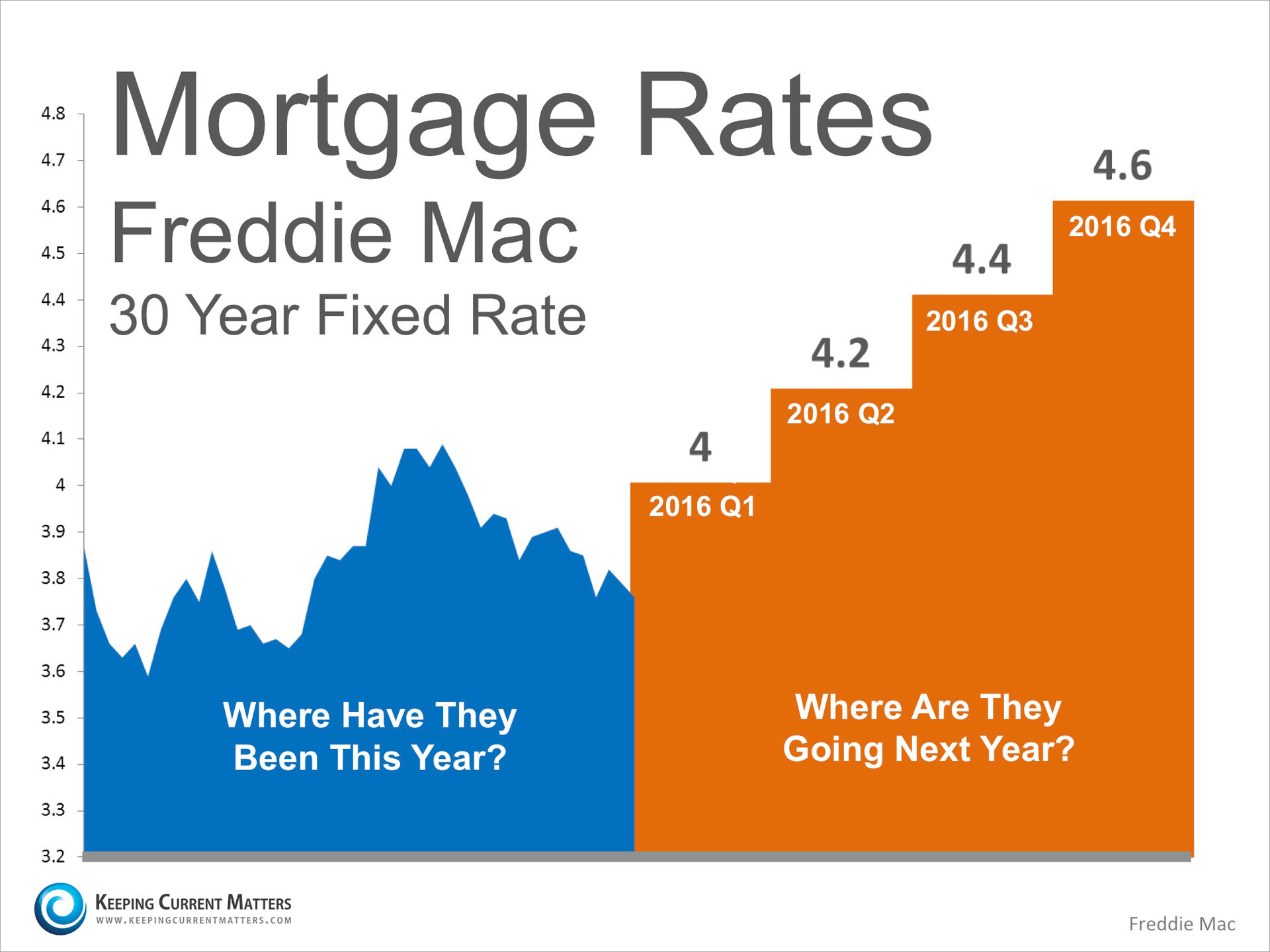

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

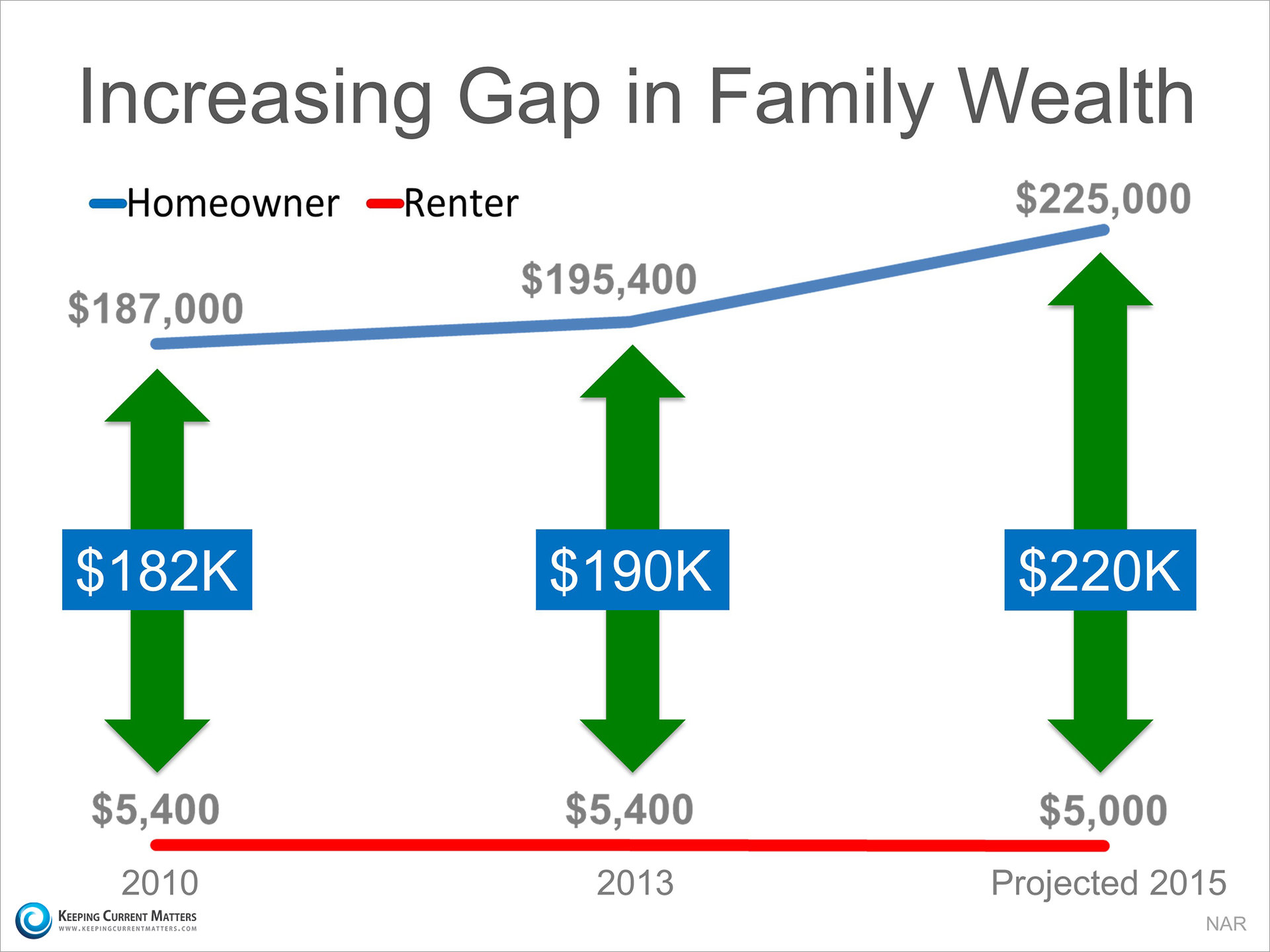

The graph below shows the widening gap in net worth between a homeowner and a renter:

![Existing Home Sales Up 3.9% [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/NAR-EHS-October-KCM.jpg)

![Singles Are Falling For Their Dream Home [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/Single-Home-Buyers-KCM.jpg)

![Fannie Mae Housing Market [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/Fannie-Mae-Housing-Market-KCM.jpg)