Homebuyers Willing to Sacrifice ‘Must-Haves’ in Favor of Good School Districts

It should come as no surprise that buying a home in a good school district is important to homebuyers. According to a report from Realtor.com,

86% of 18-34 year-olds and 84% of those aged 35-54 indicated that their

home search areas were defined by school district boundaries.

What is surprising, however, is that 78% of recent homebuyers sacrificed features from their “must-have” lists in order to find homes within their dream school districts.

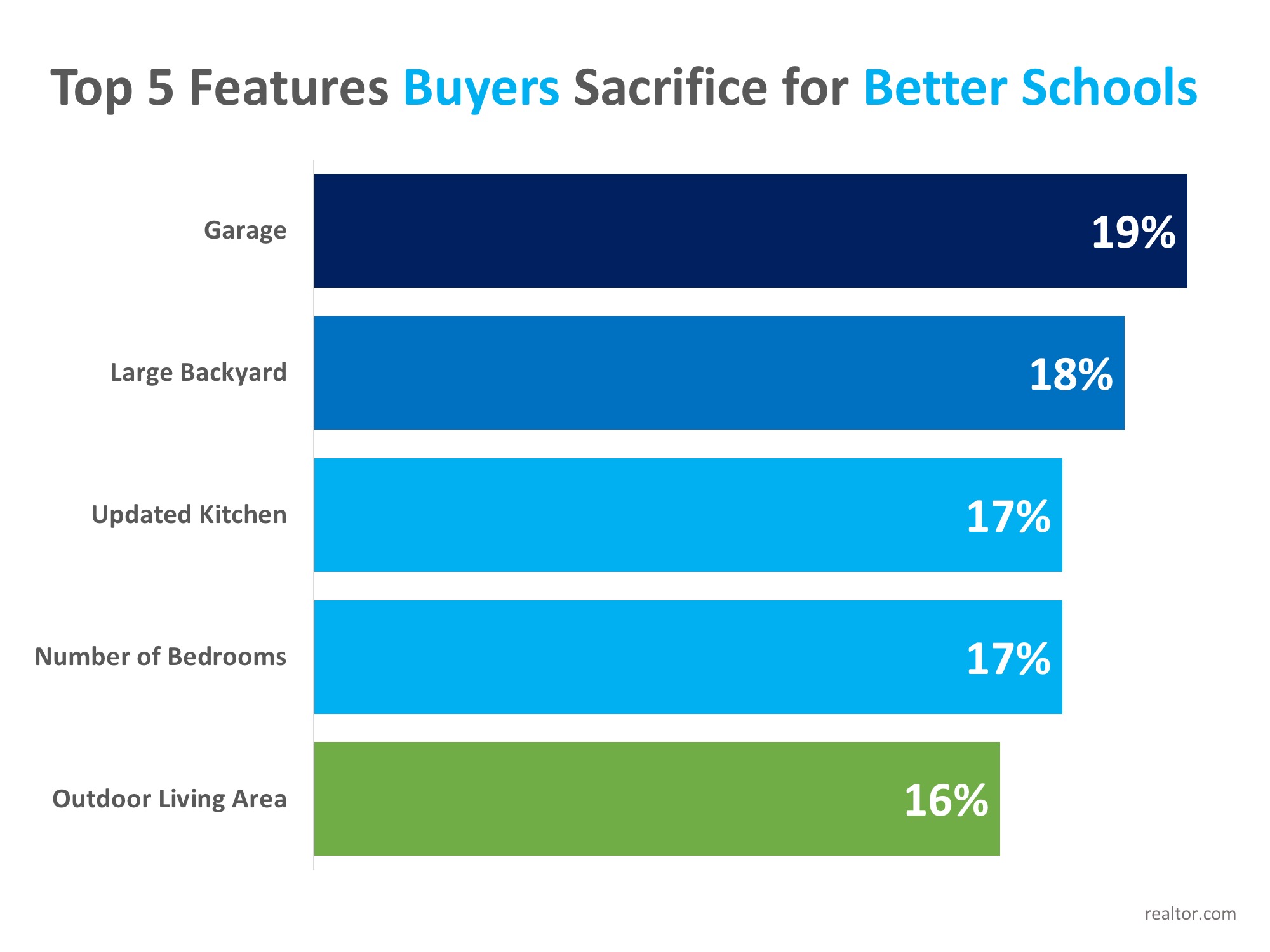

The top feature sacrificed was a garage at 19%, followed closely by a large backyard, an updated kitchen, the desired number of bedrooms, and an outdoor living area. The full results are shown in the graph below.

Buyers are attracted to schools with high test scores, accelerated academic programs, art and music programs, diversity, and before and after-school programs.

With a limited number of homes available to buy in today’s real estate market, competition is fierce for homes in good school districts. Danielle Hale, Chief Economist for Realtor.com, explained further,

What is surprising, however, is that 78% of recent homebuyers sacrificed features from their “must-have” lists in order to find homes within their dream school districts.

The top feature sacrificed was a garage at 19%, followed closely by a large backyard, an updated kitchen, the desired number of bedrooms, and an outdoor living area. The full results are shown in the graph below.

Buyers are attracted to schools with high test scores, accelerated academic programs, art and music programs, diversity, and before and after-school programs.

With a limited number of homes available to buy in today’s real estate market, competition is fierce for homes in good school districts. Danielle Hale, Chief Economist for Realtor.com, explained further,

“Most buyers understand that they may not be able to find a home that covers every single item on their wish list, but our survey shows that school districts are an area where many buyers aren’t willing to compromise.

For many buyers and not just buyers with children, ‘location, location, location,’ means ‘schools, schools, schools.’” (emphasis added)

![Is Buying a Home Really More Stressful Than Planning a Wedding? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2018/09/10125656/20180914-STM-ENG-1046x1354.jpg)