Newer maintenance-free living

in Vernon Hills! Great location is close to water park, restaurants,

entertainment, major roads, schools & parks. Island kitchen

features granite counters, stainless steel appliances. Great room with

wall of sliders. Master suite has large walk-in Elfa organized closet

& spa-like bath with separate tub & shower. Two secondary

bedrooms, hall bath, den & in unit laundry room. Two car attached

garage. $318,000 263aspenpointedr.tkmomteam.com

Click on photo below for interior pictures

mom and i sold houses together for over 22 years, until she retired in 2015. i have kept on selling houses. for sellers who are moving on, and to buyers who are moving in. real estate is such a part of our daily lives, that it carries over into everything we are. and it is of interest to so many people. so i thought i would start talking. who knows...i may actually find that i have something interesting to say :) www.tkmomteam.com

Friday, July 31, 2015

Tuesday, July 28, 2015

This doesn't apply in all areas, however it is still positive news!

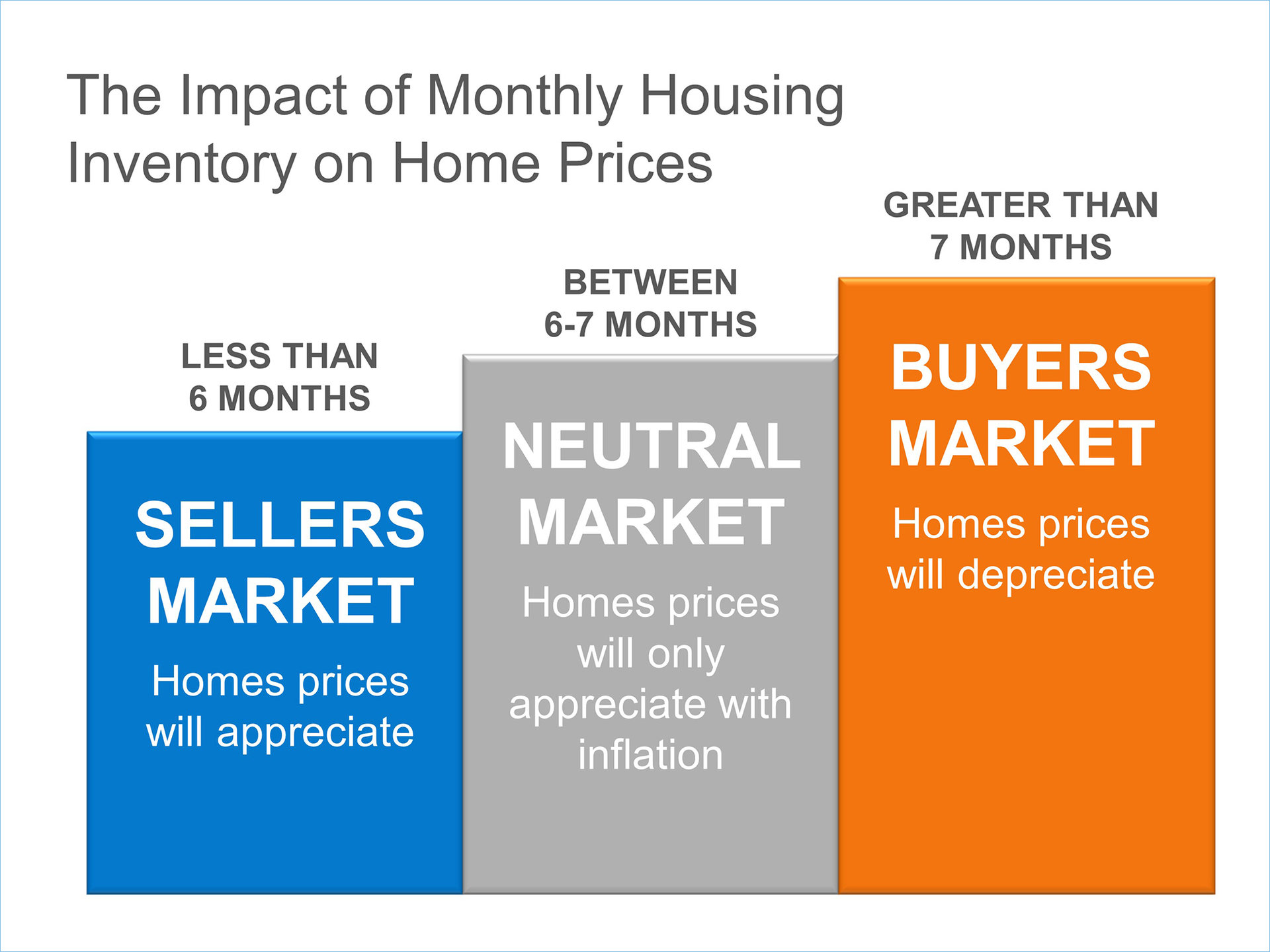

The price of any item is determined by the supply of that item, and

the market demand. The National Association of Realtors (NAR) recently

released their latest Existing Home Sales Report.

The price of any item is determined by the supply of that item, and

the market demand. The National Association of Realtors (NAR) recently

released their latest Existing Home Sales Report.Inventory Levels & Demand

Sales of existing homes rose 3.2% from May, outpacing year-over-year figures for the ninth consecutive month. Total unsold housing inventory is at a 5.0-month supply.This is down from May’s 5.1-month supply and remains below the 6 months that is needed for a historically normal market.

Consumer confidence is at the highest level in over a decade. Pair that with interest rates still around 4%, new programs available for down payments as low as 3%, and you have an attractive market for buyers.

Buyer demand for housing surged to it’s highest level since June 2013.

Prices Rising

June marked the 40th consecutive month of year-over-year price gains as the median price of existing homes sold rose to $236,400 (up 6.5% from 2014).So What Does This Mean?

The chart below shows the impact that inventory levels have on home prices.

NAR’s Chief Economist, Lawrence Yun gave some insight into the correlation:

"Limited inventory amidst strong demand continues to push home prices higher, leading to declining affordability for prospective buyers."NAR’s President, Chris Polychron added:

"The demand for buying has really heated up this summer, leading to multiple bidders and homes selling at or above asking price."

Bottom Line

If you are debating putting your home on the market in 2015, now may be the time. The number of buyers ready and willing to make a purchase is at the highest level in years. Contact a local professional in your area to get the process started.Friday, July 24, 2015

4909 Kings Way West, Gurnee IL 60031

New England influenced Providence Village home for sale. Brick &

cedar exterior, huge cul-de-sac lot. Vaulted ceilings, hardwood floors,

granite kitchen with stainless steel appliances, first floor den plus

large unfinished basement. $337,000

To see interior photos, click on the home below

To see interior photos, click on the home below

Hair isn't the only thing that has improved since the 80's!

Wednesday, July 22, 2015

4850 Kings Way West, Gurnee IL 60031

Sometimes, the little details are what turns a house into a home. Lovingly remodeled and upgraded Providence Village colonial boasts custom millwork, redesigned kitchen with top of the line cabinetry & stainless steel appliances. Gleaming wood floors throughout most of the first floor, and the master bedroom. First floor den, first floor laundry room. Cozy family room with fireplace. Full finished basement boasts wet bar, powder bath & additional office. $390,000

To see interior photos, click picture below:

To see interior photos, click picture below:

Libertyville is ranked #15 on Nerdwallet's list of the best places to start a business in Illinois!

Tuesday, July 21, 2015

Need a reason to buy a home, instead of renting one?

Check out these Keeping Current Matters statistics...

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As The Joint Center for Housing Studies at Harvard University explains:

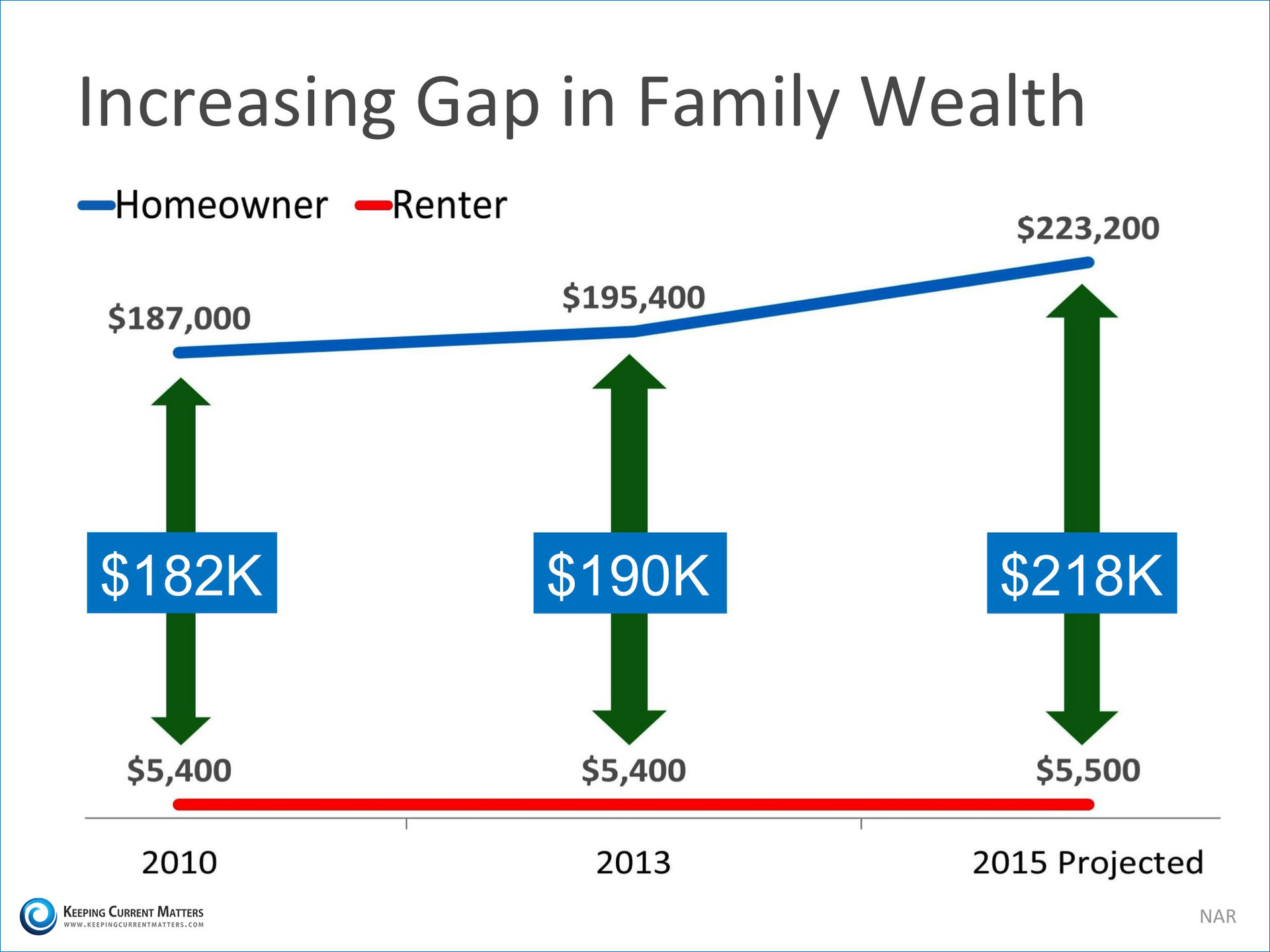

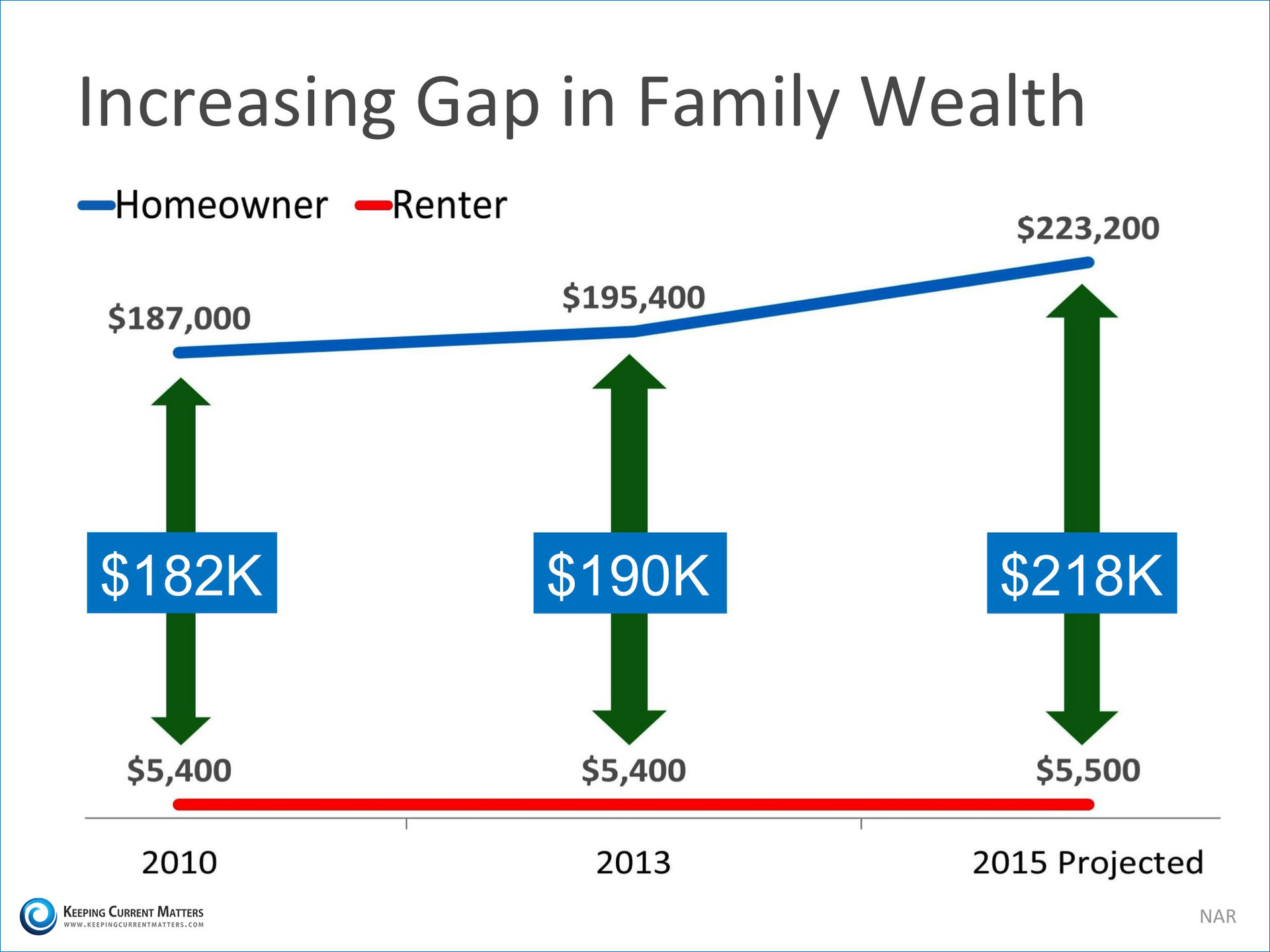

The graph below shows the widening gap in net worth between a homeowner and a renter:

There are some people that have not purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage - either your mortgage or your landlord’s.

As The Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return.Christina Boyle, a Senior Vice President, Head of Single-Family Sales & Relationship Management at Freddie Mac, explains another benefit of securing a mortgage vs. paying rent:

That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person with that equity.

The graph below shows the widening gap in net worth between a homeowner and a renter:

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, owning might make more sense than renting since home values and interest rates are projected to climb.158B Golf Road, Libertyville IL 60048

Updated 2 bedroom, 2 bath Libertyville condo offers maintenance free

living! Laundry room in unit, plus an attached 1 car garage.

Affordably priced too! $153,900

Click on photo below, to see interior pictures

Click on photo below, to see interior pictures

Monday, July 20, 2015

18904 Woodale Trail, Lake Villa IL 60046

Beautifully updated Regency model tucked on a private lot in Deerpath Estates.

To see interior photos, click on the picture below.

To see interior photos, click on the picture below.

18493 Springwood Drive, Grayslake IL 60030

Freshly painted and ready to go! Four bedroom Oakwood home features

hardwood flooring, vaulted ceiling, fireplace and unfinished basement.

$258,900 www.18493springwooddrive.tkmomteam.com

Click photo below to see interior pictures.

Click photo below to see interior pictures.

Should I sell, or should I rent...

Looking to move, but not sure if you should sell your current home, or rent it instead? Read what Keeping Current Matters has to say...

The results of Fannie Mae’s June 2015 National Housing Survey, were just released showing that more and more homeowners are warming up to the idea that now may be a great time to sell their home.

The amount of respondents that stated that now is a good time to sell rose three percentage points to a survey high of 52%; which may translate to a healthier market as more homes are listed in the coming months.

At the same time “the percentage of respondents who expect home rental prices to go up rose to 59% – a new survey high.” Doug Duncan, senior vice president and chief economist at Fannie Mae, gave this insight: “The expectation of higher rents is a natural outgrowth of increasing household formation by newly employed individuals putting upward pressure on rental rates.”

There is a chance that those who believe rental prices will rise may consider renting their house rather than selling it at this time.

However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for. Are you ready to be a landlord?

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

The results of Fannie Mae’s June 2015 National Housing Survey, were just released showing that more and more homeowners are warming up to the idea that now may be a great time to sell their home.

The amount of respondents that stated that now is a good time to sell rose three percentage points to a survey high of 52%; which may translate to a healthier market as more homes are listed in the coming months.

At the same time “the percentage of respondents who expect home rental prices to go up rose to 59% – a new survey high.” Doug Duncan, senior vice president and chief economist at Fannie Mae, gave this insight: “The expectation of higher rents is a natural outgrowth of increasing household formation by newly employed individuals putting upward pressure on rental rates.”

There is a chance that those who believe rental prices will rise may consider renting their house rather than selling it at this time.

However, if you have no desire to actually become an educated investor in this sector, you may be headed for more trouble than you were looking for. Are you ready to be a landlord?

Before renting your home, you should answer the following questions to make sure this is the right course of action for you and your family.

10 Questions to ask BEFORE renting your home

- How will you respond if your tenant says they can’t afford to pay the rent this month because of more pressing obligations? (This happens most often during holiday season and back-to-school time when families with children have extra expenses).

- Because of the economy, many homeowners cannot make their mortgage payment. What percentage of tenants do you think cannot afford to pay their rent?

- Have you interviewed experienced eviction attorneys in case a challenge does arise?

- Have you talked to your insurance company about a possible increase in premiums as liability is greater in a non-owner occupied home?

- Will you allow pets? Cats? Dogs? How big a dog?

- How will you actually collect the rent? By mail? In person?

- Repairs are part of being a landlord. Who will take tenant calls when necessary repairs come up?

- Do you have a list of craftspeople readily available to handle these repairs?

- How often will you do a physical inspection of the property?

- Will you alert your current neighbors that you are renting the house?

Bottom Line

Renting out residential real estate historically is a great investment. However, it is not without its challenges. Make sure you have decided to rent the house because you want to be an investor, not because you are hoping to get a few extra dollars by postponing a sale.Friday, July 17, 2015

Have you ever wondered...

...what the impact of owning a home has on financial stability in your retirement years?

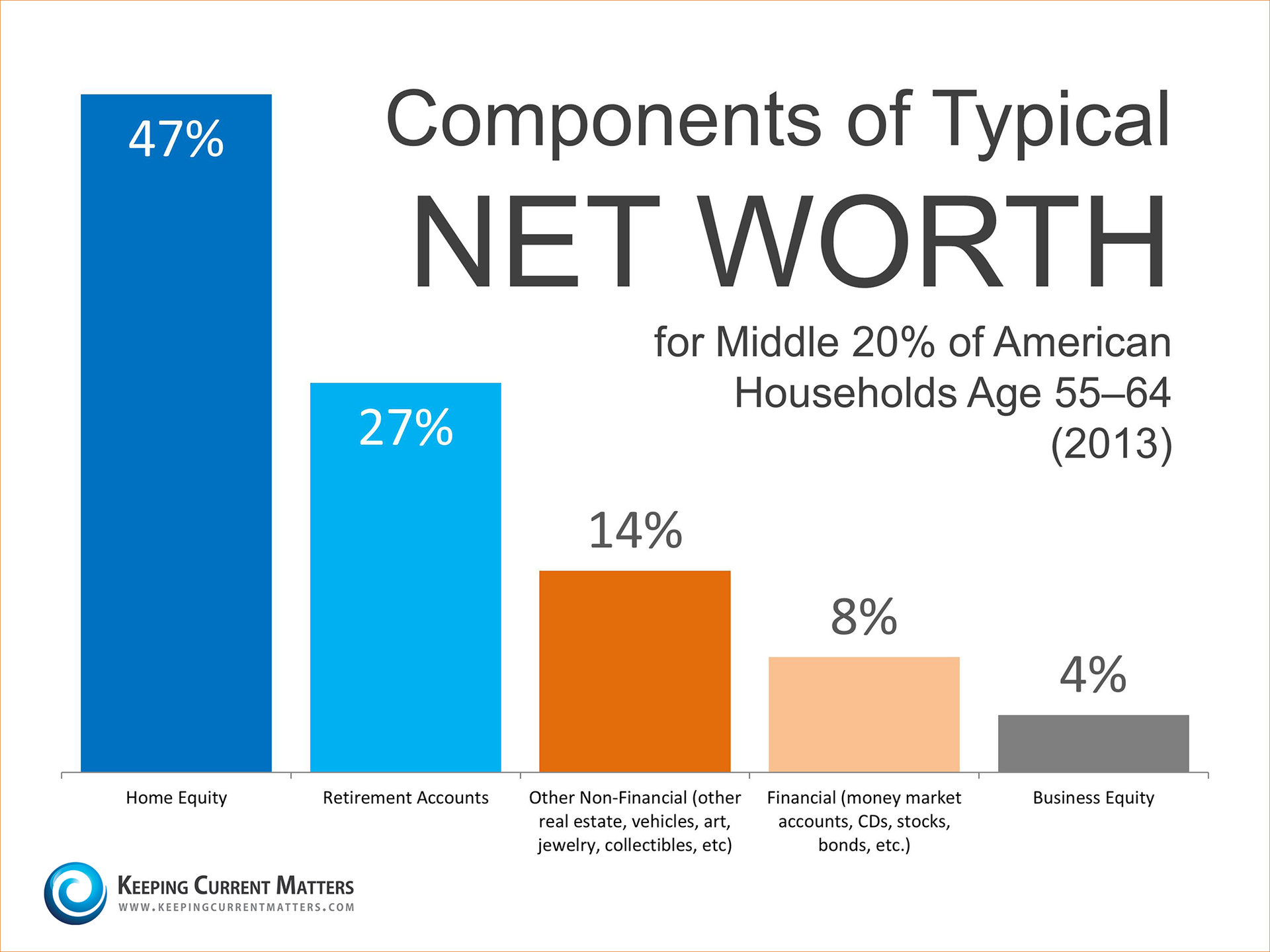

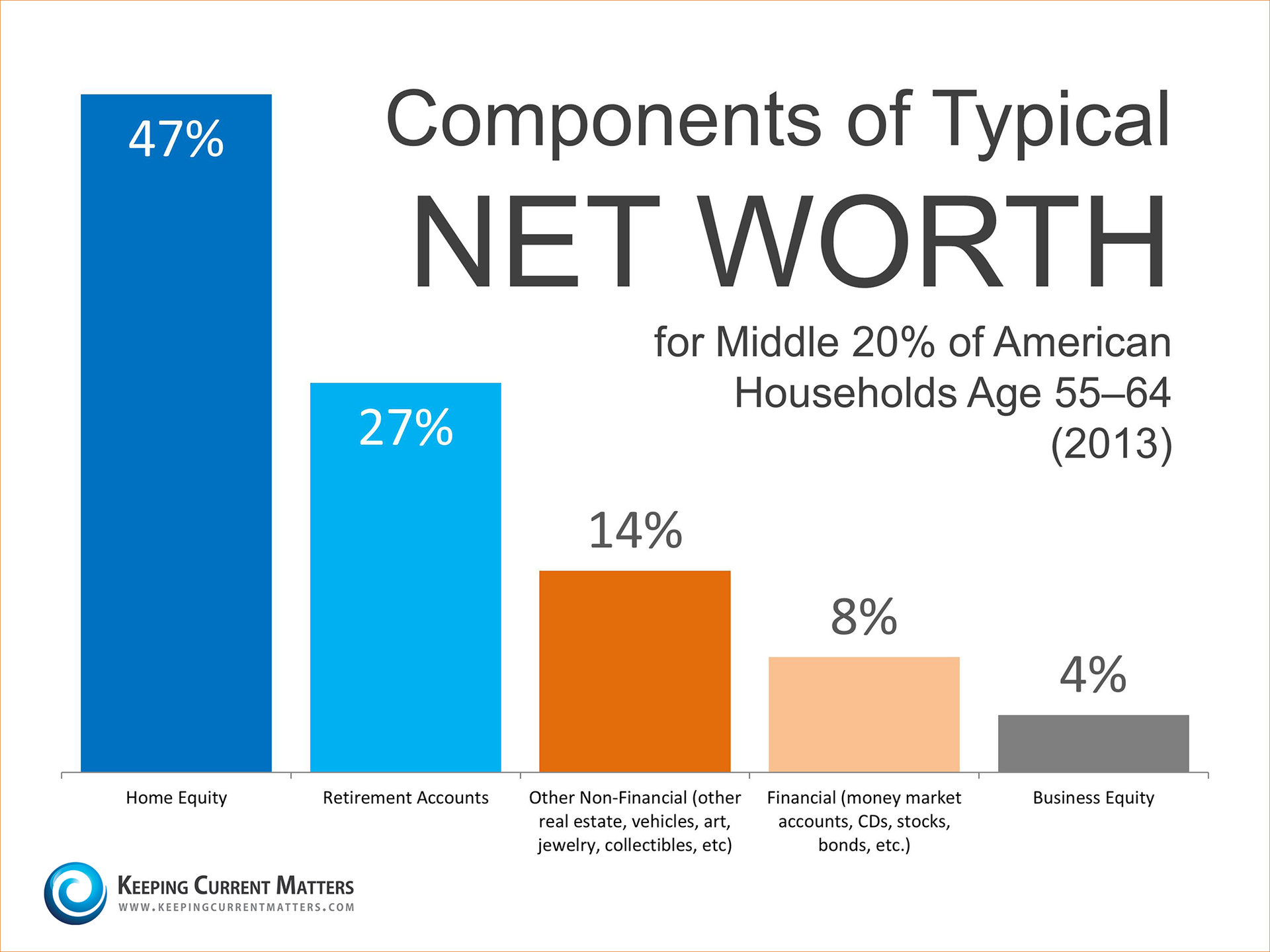

There has been much talk about homeownership and whether it is a true vehicle for building wealth. A new report looks at the impact owning a home has on the financial wellbeing of people closing in on their retirement years (ages 55-64).

In recently released study by the Hamilton Project, Ten Economic Facts about Financial Well-Being in Retirement, it was revealed that:

1. Middle-class households near retirement age have about as much wealth in their homes as they do in their retirement accounts.

Obviously, the data again proves that homeownership has a big role in building wealth for American families.

There has been much talk about homeownership and whether it is a true vehicle for building wealth. A new report looks at the impact owning a home has on the financial wellbeing of people closing in on their retirement years (ages 55-64).

In recently released study by the Hamilton Project, Ten Economic Facts about Financial Well-Being in Retirement, it was revealed that:

1. Middle-class households near retirement age have about as much wealth in their homes as they do in their retirement accounts.

“Over the past quarter century the largest single source of wealth for all but the richest households nearing retirement age has been their homes, which accounted for about two-fifths of net worth in the early 1990s and accounts for about one-third today.”2. Home equity is a very important source of net worth to all but the wealthiest households near retirement age.

“Home equity is an important source of wealth for middle income households, accounting for more than one-third of total net worth for the second, third, and fourth quintiles of the net worth distribution… The fifth quintile has a much larger share in business equity—almost a quarter—than any other quintile. (The figure leaves out the bottom quintile of households because they have negative net worth. It is likely that these households will rely almost exclusively on Social Security in retirement.)”Here is an asset breakdown for the middle 20% of Americans determined by median net worth ($165, 720):

Obviously, the data again proves that homeownership has a big role in building wealth for American families.

14368 Dan Patch, Libertyville IL 60048

Spacious Green Oaks 4 bedroom enjoys tons of updates inside and out. So great - it sold in 3 days! $589,900

To see interior photos, click on picture below

Wednesday, July 15, 2015

12 Portshire Drive, Lincolnshire IL 60069

To see interior photos, please click house below...

Tuesday, July 14, 2015

Ever wonder what the true cost of waiting to buy a home is?

Have you every asked yourself "what if I wait to buy?" Keeping

Current Matters helps answer that question for you. Read their article

below:

First-time homebuyers are flocking to the housing market in greater numbers than any time in the last few years. Renters who are ready and willing to buy are now realizing that they are also able to as well. Many first-time buyers are Millennials (born between 1981 – 1997).

If you are one of the many in this generation who sees your friends and family diving head first into the real estate market, and wonder if now is the time for you to do the same, keep reading!

The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.

Let’s look at an example of what the experts are predicting for the upcoming year, and what that really would mean for you. Let’s say you’re 30 and your dream house costs $250,000 today. Right now mortgage interest rates are at or about 4%.

Freddie Mac predicts that over this same period of time, interest rates will be a full point higher at 5.0%. Your new payment per month is now $1,410.50.

Or you could look at it this way:

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a deck for entertaining. We could come up with 100’s of ways to spend $2,603, and we’re sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $78,105.60, all because when you were 30 you thought moving in 2015 was such a hassle or loved your apartment too much to leave yet.

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready. But if they showed you that you could save $78,000 you’d at least listen to what they had to say.

They say hindsight is 20/20, we’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

First-time homebuyers are flocking to the housing market in greater numbers than any time in the last few years. Renters who are ready and willing to buy are now realizing that they are also able to as well. Many first-time buyers are Millennials (born between 1981 – 1997).

If you are one of the many in this generation who sees your friends and family diving head first into the real estate market, and wonder if now is the time for you to do the same, keep reading!

The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.

Let’s look at an example of what the experts are predicting for the upcoming year, and what that really would mean for you. Let’s say you’re 30 and your dream house costs $250,000 today. Right now mortgage interest rates are at or about 4%.

Your monthly mortgage payment (principal & interest only) would be $1,193.54.

But you’re busy, you like your apartment, and moving is such a hassle. You decide to wait until next year to buy. CoreLogic predicts that home prices will appreciate by 5.1% in the next 12 months; this means that same house you loved now costs, $262,750.Freddie Mac predicts that over this same period of time, interest rates will be a full point higher at 5.0%. Your new payment per month is now $1,410.50.

The difference in payment is $216.96 PER MONTH!

That’s basically like taking $8 and tossing it out the window EVERY DAY!Or you could look at it this way:

- That’s your morning coffee everyday on the way to work (average $2) with $10 left for lunch!

- There goes Friday Sushi Night! ($50 x 4)

- Stressed Out? How about a few deep tissue massages with tip!

- Need a new car? You could get a brand new car for $217 a month.

Had your eye on a vacation in the Caribbean? How about a 2-week trip through Europe? Or maybe your new house could really use a deck for entertaining. We could come up with 100’s of ways to spend $2,603, and we’re sure you could too!

Over the course of your 30 year loan, now at age 61, hopefully you are ready to retire soon, you would have spent an additional $78,105.60, all because when you were 30 you thought moving in 2015 was such a hassle or loved your apartment too much to leave yet.

Or maybe there wasn’t an agent out there who educated you on the true cost of waiting a year. Maybe they thought you wouldn’t be ready. But if they showed you that you could save $78,000 you’d at least listen to what they had to say.

They say hindsight is 20/20, we’d like to think that 30 years from now when you are 60, looking back, you would say to buy now…

692 Penny Lane, Gurnee IL 60031

Tucked in the heard of one of Gurnee's hottest selling neighborhoods,

this stunning Maple model has been refreshingly remodeled. To see

photos, click on the picture below...

Friday, July 10, 2015

Short sale popularity a few years ago equals buyers who are now back in the buyer pool...

![Boomerang Buyers Coming Back in Force [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/07/Boomerang-KCM.jpg) |

Subscribe to:

Posts (Atom)

![Cost Across Time [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/07/20150724-Cost-Across-Time-KCM.jpg)