2 Myths That May Be Holding Back Buyers

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.”

Many believe that they need at least 20% down to buy their dream home, but many programs actually let buyers put down as little as 3%.

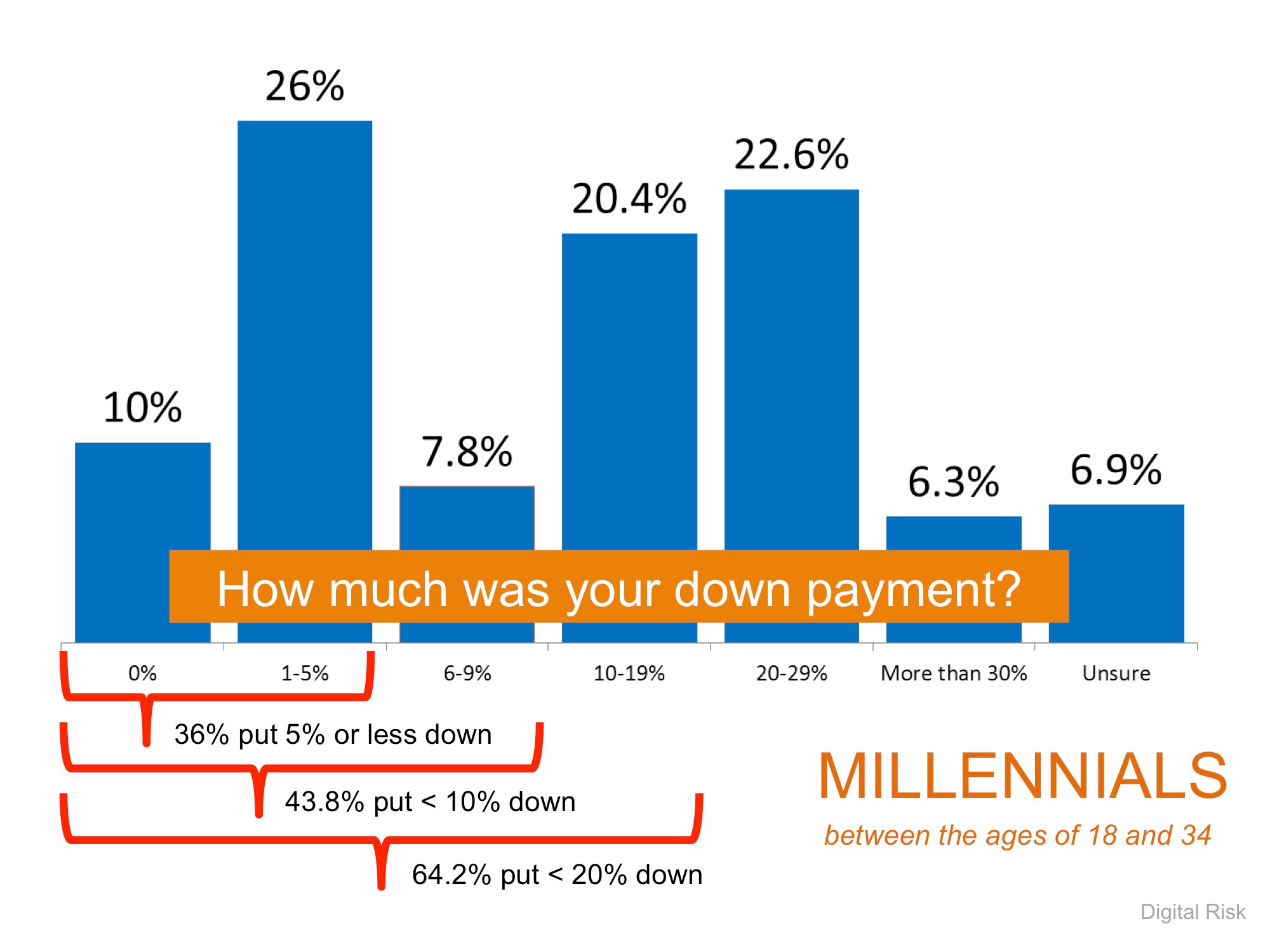

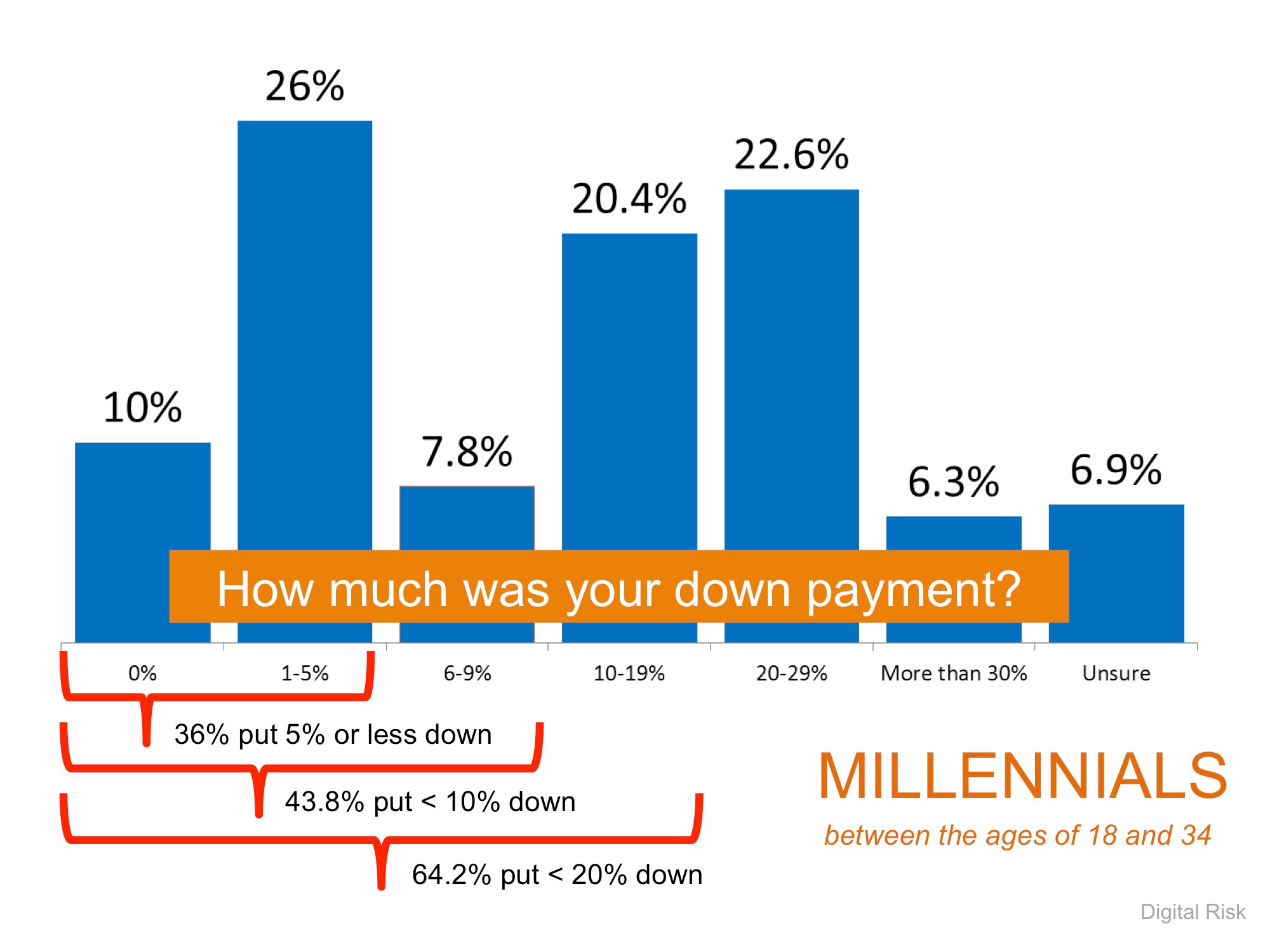

Below are the results of a Digital Risk survey of Millennials who recently purchased a home.

As you can see, 64.2% were able to purchase their home by putting down less than 20%, with 43.8% putting down less than 10%!

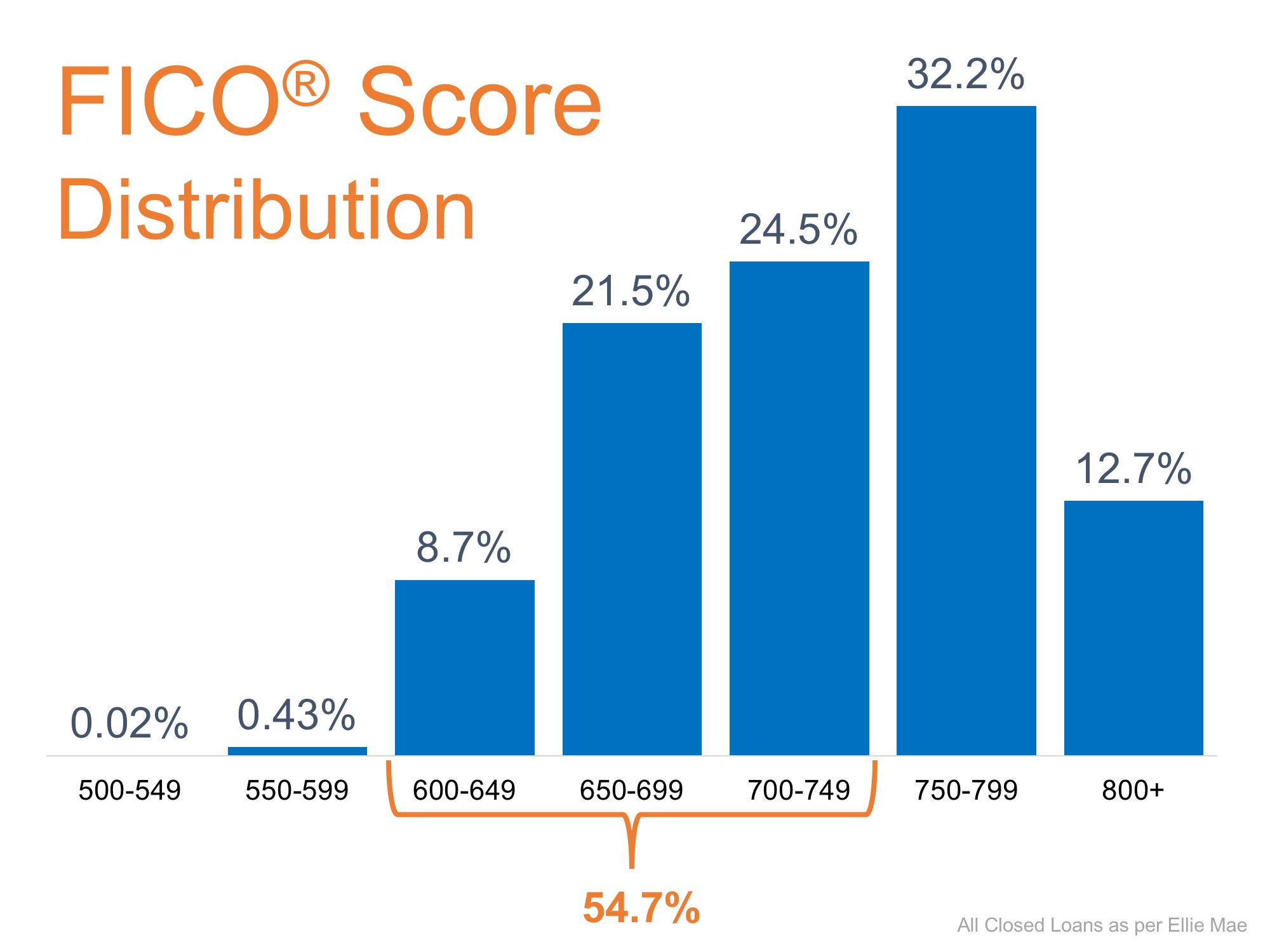

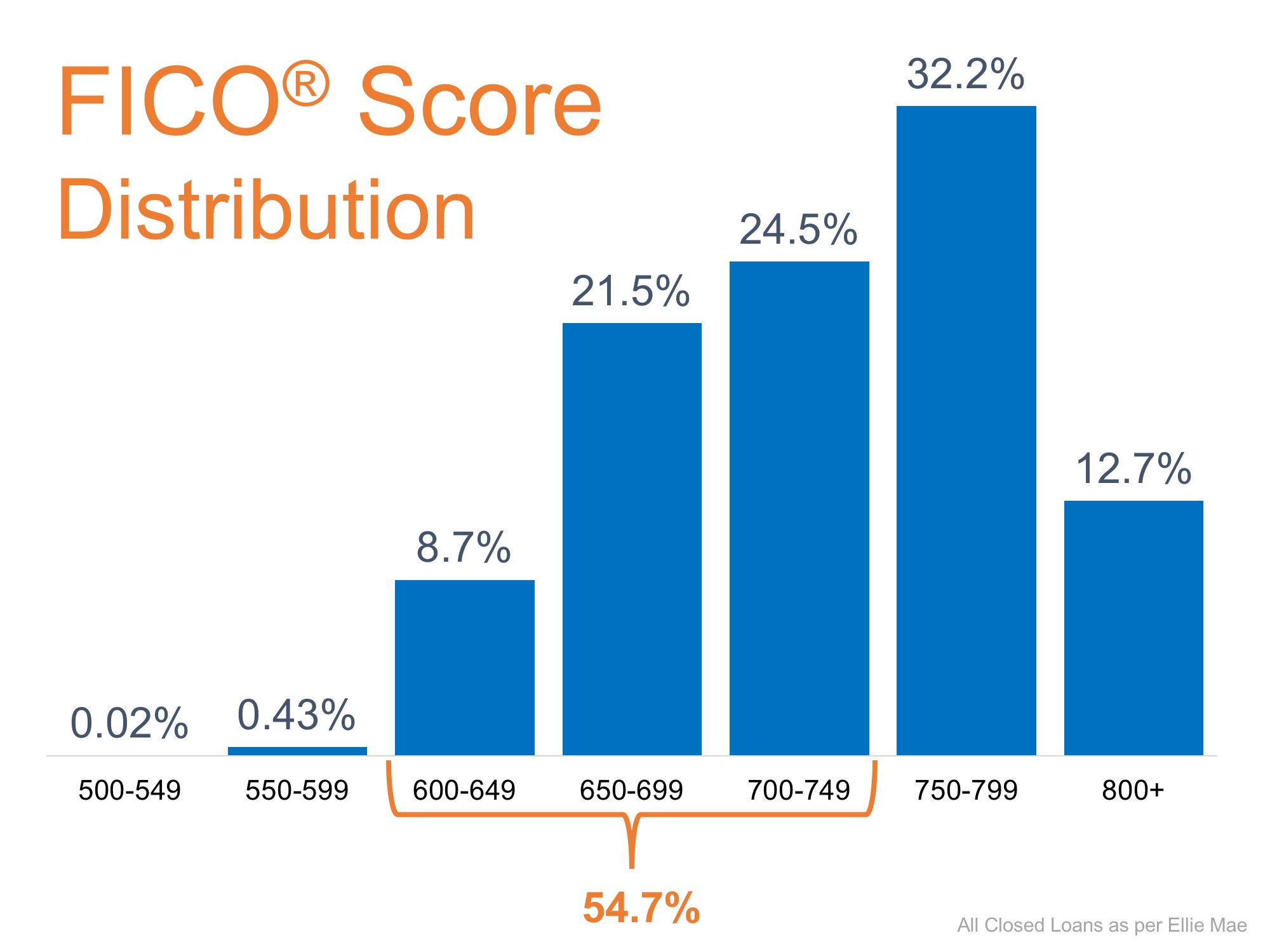

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As you can see below, 54.7% of approved mortgages had a credit score of 600-749.

Myth #1: “I Need a 20% Down Payment”

Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required.Many believe that they need at least 20% down to buy their dream home, but many programs actually let buyers put down as little as 3%.

Below are the results of a Digital Risk survey of Millennials who recently purchased a home.

As you can see, 64.2% were able to purchase their home by putting down less than 20%, with 43.8% putting down less than 10%!

Myth #2: “I need a 780 FICO Score or Higher to Buy”

The survey revealed that 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary to qualify.Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As you can see below, 54.7% of approved mortgages had a credit score of 600-749.

No comments:

Post a Comment